Delete Journal Entries

Whether you entered a trade incorrectly, or want to remove Cancelled Orders from your Virtual or Manual Account, you have the ability to delete a Journal Entry.

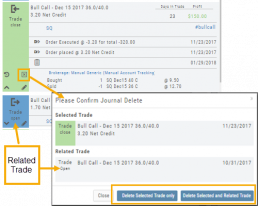

Simply expand the Trade tab and click on the ![]() icon.

icon.

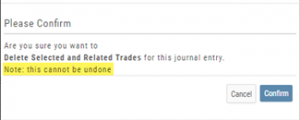

If you are deleting Cancelled or Expired orders, you’ll be prompted to confirm you want to delete the entry.

For trades that have a specific Open and/or a specific Close, you’ll be prompted to choose either Selected Trade or Selected and Related Trade, if applicable.

Prior to deleting your selection, you’ll be prompted to confirm the action. Once deleted, the trade cannot be restored.

Note: Deleting a Journal entry for a Manual Account will remove the trade completely from both the Journal and Manual Account.

Deleting a Journal entry for Real or Virtual Accounts only remove the Journal entry, and the trade will remain in the account.

The Power of Time

The Backtesting feature allows for an interactive way to understand the characteristic of the strategy.

You can also see it’s performance over real data without having to wait for the market.

Give it a try!

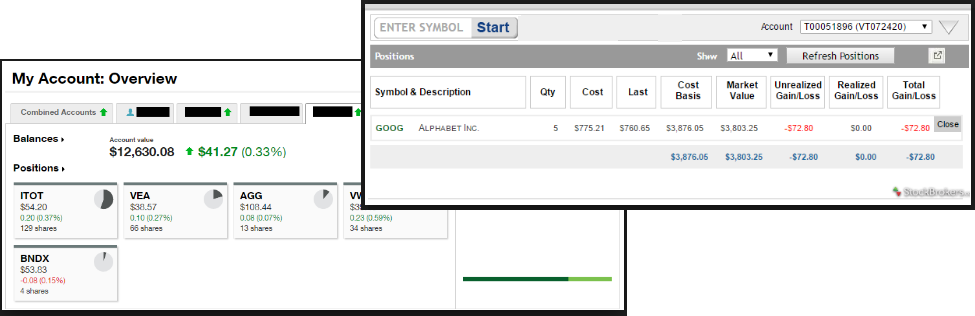

Account Differences Explained

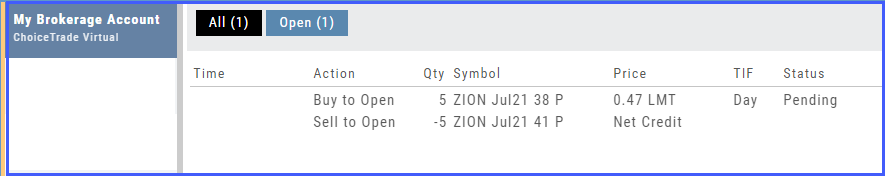

When you set up your Live Account with TD Ameritrade, Choice Trade or other Brokerage you may notice account value differences on the Positions summary tab.

The Trade Tool Positions Account Values are tied to the Bid price (if you own a stock or option) and Ask price (if you are short a stock or option). Were you to close the position, you would receive the corresponding price – or better, since you are able to try to get a better price than Bid/Ask. This method ensures you will get at least the listed value – or better.

Choice Trade Accounts can be set up to have the price shown in the Positions Summary tied to the Bid/Ask or the default, “Last Trade Price“. Last Trade Price differs from Bid/Ask in that it shows the most recent transaction price, but does not always reflect the price you will receive if you were to buy or sell the security.

TD Ameritrade ties trade values to Mark – the point between Bid and Ask. Some trades will be closed at this price, but not all. Mark does not take into account if you own or are short a position, it is simply the halfway point between the two.

From Strategize to Analyze to Trade

Any strategy-specific options trade will have ‘Analyze’ and ‘Trade’ in the Action Icon.

Click ‘Analyze’ to see the trade in the options chain. From there, you can edit or click ‘Trade’ to have the trade sent to the Order Ticket of your brokerage account.

Give it a try!

Virtual Account Buying Power Calculations

Virtual Account Buying Power Calculation

This is an example of how Buying Power is calculated. Check with your broker for specifics on your real accounts.

Margin

All margin accounts are subject to a $2,000 minimum equity requirement. ChoiceTrade requires $25,000 in account equity for naked put writing and $100,000 for naked call writing. Please click here to read our Risk Disclosure for important information regarding daytrading rules. Please see the terms of ChoiceTrade's Margin and Options agreements.| POSITION | INITIAL MARGIN | MAINTENANCE MARGIN |

| Long Stock | 1. 50% of the purchase price of marginable securities 2. 100% of the purchase price of non-marginable securities $2000 minimum margin account equity for all margin transactions $500 minimum cash balance required for Bulletin Board and OTC Market Stocks |

1. 25% of the current market value of the long securities positions in marginable securities. 2. 100% of the current market value of the long securities positions in non-marginable securities; See Special Notes below |

|---|---|---|

| Short Stock | The greater of: 1. 50% of the sale price of marginable securities; or 2. $5.00 per share $2000 minimum margin account equity for all margin transactions |

1. For marginable securities priced $2.50/share and under: $2.50/share 2. For marginable securities priced $2.51 to $5.00 per share: 100%. 3. For marginable securities priced $5.01 and above: greater of 50% or $5.00 per share. See Special Notes below |

| Long Calls or Puts | 100% of the cost of the options. | 100% of the current market value of options. |

| Short Uncovered Calls | The greater of: 1. 100% of the option proceeds plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. 100% of the option proceeds plus 10% of the underlying stock $100,000 minimum margin account equity |

The greater of: 1. The current marked-to-market value of the option plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. The current marked-to-market value of the option plus 10% of the underlying stock |

| Short Puts | The greater of: 1. 100% of the option proceeds plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. 100% of the option proceeds plus 10% of the strike price. $100,000 minimum margin account equity |

The greater of: 1. The current marked-to-market value of the option plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. The current marked-to-market value of the option plus 10% of the strike price |

| Short Covered Calls | None required on short call. | None required on short call. |

| Debit Spread | 100% of the net debit | 100% of the current market value of the position. |

| Credit Spread Market Orders |

Value of the difference between the strike prices $2,000 minimum margin account equity |

The lesser of: 1. Value of the difference between the strike prices of the vertical or; 2. The maintenance margin requirement of the short call or put |

| Credit Spread Limit Orders |

Value of the difference between the strike prices less the credit to be received $2,000 minimum margin account equity |

The lesser of: 1. Value of the difference between the strike prices of the vertical or; 2. The maintenance margin requirement of the short call or put |

| Long Butterflies/ Condors | 100% of cost of butterfly or condor. | 100% of current market value of butterfly or condor. |

| Short Butterflies/ Condors | Initial margin requirement of the short vertical of the butterfly or condor. | Maintenance margin requirement of the short vertical of the butterfly or condor. |

| Long Straddles/ Strangles | 100% of the cost of the straddle or strangle. | 100% of the current market value of the straddle or strangle. |

| Short Straddles/ Strangles | The initial margin requirement for the short put or short call, whichever is greater, plus the premium of the other option; $100,000 minimum margin account equity |

The maintenance margin requirement for the short put or short call, whichever is greater, plus the premium of the other option; |

| Long Call or Put Calendar Spreads |

100% of the cost of the calendar spread. | 100% of the current market value of the calendar spread. |

| Short Call or Put Calendar Spreads |

Initial margin requirement of short call or put; $2,000 minimum margin account equity |

Maintenance margin requirement of short call or put; |

|

Special Notes Volatile Stock Requirement: Some stocks deemed to be volatile may be held at a higher requirement. New Issues: Generally, newly issued stocks have a 100% initial and maintenance requirement for the first 30 days of trading Leveraged ETFs: Minimim cash requirement for long positions: 2X ETF (200% Leveraged) = 50% 3X ETF (300% Leveraged) = 100% Minimim cash requirement for short positions: 2X ETF (200% Leveraged) = 60% 3X ETF (300% Leveraged) = 100% |

||

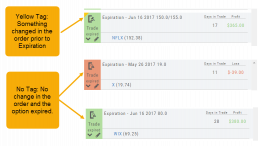

Journal - Color Tagging

After Reconciling your closed trades, click “OK” to have the Journal entries updated.

Yellow tag: There was a change in the Option position. For example, an option was exercised before expiration – or the order was adjusted.

No tag: There was no change and the Option expired worthless.

Green Tab: Profitable trade

Red Tab: Losing trade

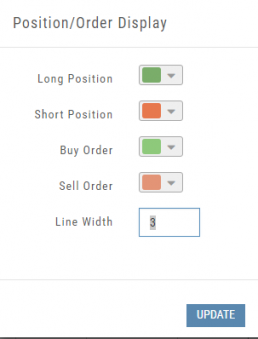

Working Orders Displayed on Chart

Charts display working orders and existing positions of selected brokerage accounts, currently Choice Trade and TD Ameritrade. More brokerages will be forthcoming.

- Stocks show a horizontal line at the entry price.

- Options show a horizontal line at the strike price.

- Green for Long and Red for Short.

The group of 4 icons, located above the Working Order, allow you to Edit (Gear), Hide(Eye) Refresh (Circle arrows) or Remove (X).

![]()

Display choices including colors and line width are available in settings by clicking the “Gear” Icon.

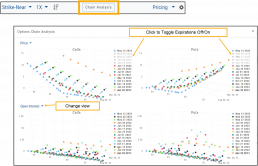

Options Chain Analysis

The Option Chain pages offers a 3-D analysis comparing expiration dates by selected criteria.

Click on “Chain Analysis” to display the graph.

Use the drop-down boxes to view the tables by Implied Volatility, Volume, Open Interest, Price, Extrinsic Value, Delta or Intrinsic Value.

Toggle the view by using the clickable legend to select the Expiration Dates to view.

Other Navigation

Icons = Navigation

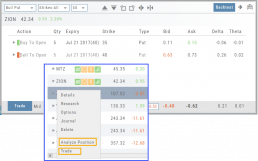

The Action (Arrow) icon will provide different actions depending on where you are in the platform. For example if you are in the Market or Find tab, ‘Detail‘ will provide a Quote Popup. ‘Research‘ will take you to the Dashboard – overview – of the stock. ‘Options‘ will take you to that part of the platform etc.

When in a “Trade Finder Scan” (identified by the ![]() icon), the Action icon choices includes: ‘Analyze Position’ which will take you to the Options tables and/or ‘Trade’ which will lead you to the Order Ticket of the Brokerage Account from the menu.

icon), the Action icon choices includes: ‘Analyze Position’ which will take you to the Options tables and/or ‘Trade’ which will lead you to the Order Ticket of the Brokerage Account from the menu.

The Action Icon is also found in the Journal. Under the “Positions” tab, clicking on the icon allows you to Expand/Collapse details of the trade, Analyze or Close the trade among other choices.