Life Of Trade Icon/Color Codes

The Life of Trade Icon and Tab/Trade entry color show help you identify the status of your trades.

Icon Display and Color Coding

Note: Orders are automatically updated when you login to your trading account, whether Live, Virtual or Manual

Blue – Hollow Dots – No Connection

Blue – Hollow Dots – No Connection

Active Order or Open Original Trade

Yellow – Hollow Dots – Open Connection

Yellow – Hollow Dots – Open Connection

The Original Trade has been adjusted, but is still an Active Trade

Yellow – Solid Dots – Closed Connection

Yellow – Solid Dots – Closed Connection

The Trade and any Adjustments have been closed, but one or more entries need to be

Matched or Reconciled

![]()

Green – Solid Dots – Closed Connection

Closed trade – which includes any adjustments – resulting in a Profit

![]()

Red – Solid Dots – Closed Connection

Closed Trade – which includes any adjustments – resulting in a Loss

Trade Entry Lines

Note: Depending on the Theme used, the following colors will vary. The bar color denotes whether the trade needs action – such as Reconciliation or Matching to another trade.

Blue Line

No action needed on these entries. The colored left tab shows the status of each trade:

Blue: (Open Trade, hollow dots, no connection), Yellow: (Adjusted, hollow dots, partial connection), Red: Loss (Closed, solid dots, connected), Green: Profit (Closed, solid dots, connected)

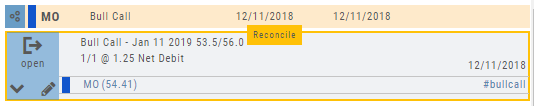

Yellow Line

Action is needed on these trade entries. The Trade may have gone through Expiration and needs to be Reconciled. By clicking on the Trade Line, the Trade Tab will display:

Once the action is completed, the entry will update on all Journal tables including the Tags, P/L Graph & Insight tabs.

It is important to reconcile expired trades to properly display profit and provide updated analytical information on your trading success.

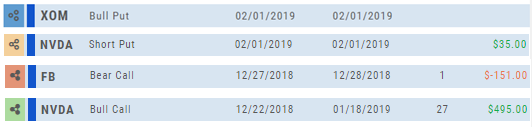

Color Codes of The Trade Journal

The Tabs on the Journal are Color Coded for Easy Understanding of the Trade

Primary Tab Color Coding (see below for expiration tab coding)

Note: Orders are automatically updated when you check order status. Just make sure to select the time frame to cover the trades that need updating

Light Blue

Light Blue

Active Live Order

This indicates that you have a current live order

Dark Blue

Dark Blue

Trade – Open

This indicates the opening transaction of a trade

Gray

Gray

Expired or Canceled Order

This can be from a order that you canceled, or a day order that did not get filled

Green

Green

Closed Trade – Profit

This indicates a trade that you closed for a profit

Red

Red

Closed Trade – Loss

This indicated a trade that you closed for a loss

Yellow

Yellow

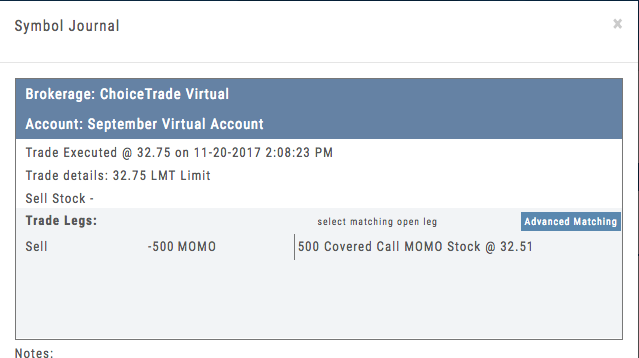

Closed Trade – Unmatched – Requires action to match to related

trade. Expand tab to see detail of trade.

Unmatched Trades can happen if there are multiple trades and an entry trade needs to be identified or because a multi-leg trade was split on exit, or change of stock position when an option expired (exercise/assignment)

Unmatched Trades can happen if there are multiple trades and an entry trade needs to be identified or because a multi-leg trade was split on exit, or change of stock position when an option expired (exercise/assignment)

This is easily matched by clicking the edit icon (pencil) and selected which open order to match to. In some cases there may only be one, and it is simply a verification.

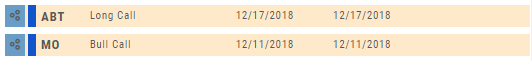

Expiration Tab/Tagging Colors

Red or Green with No Color Tagging

Red or Green with No Color Tagging

This indicated the option trade expired Out of the Money (OTM)

There were no options exercised or assigned through expiration

Red or Green with Dark Green Color Tag

Red or Green with Dark Green Color Tag

This indicated that there were ITM options exercised/assigned

However, there was no change is stock ownership. Example: Bull Call where both legs were exercised/assigned.

Red or Green with Yellow Color Tag

Red or Green with Yellow Color Tag

This indicates a change in stock ownership through exercise/assignment

This will happen with single leg options trade or where one leg of a spread was ITM at expiration

It is important to reconcile expired traded to properly display profit. If there are unreconciled expired options, the reconciliation window will automatically display when you go to the options tab.

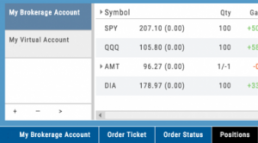

Brokerage Access

Trade directly with select Brokers.

The Broker menu is located in the lower left corner of the screen and is always accessible. From here you can see your balance, positions, and orders.

There is also an integrated Order Ticket. This can be accessed directly or from any of the “Buy”, “Sell” or “Trade” buttons or from clicking on the Action Icon menu.

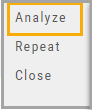

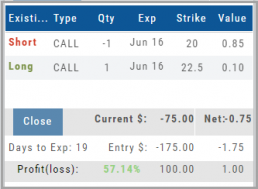

Evaluate Existing Positions

Positions will automatically show on the options chain for the active brokerage account.

You can also access directly from Broker Positions. Select “Analyze” from the Action menu.

This will display the current values as well as entry cost and current P/L.

Here you can also close the position or evaluate adjustments on the trade.

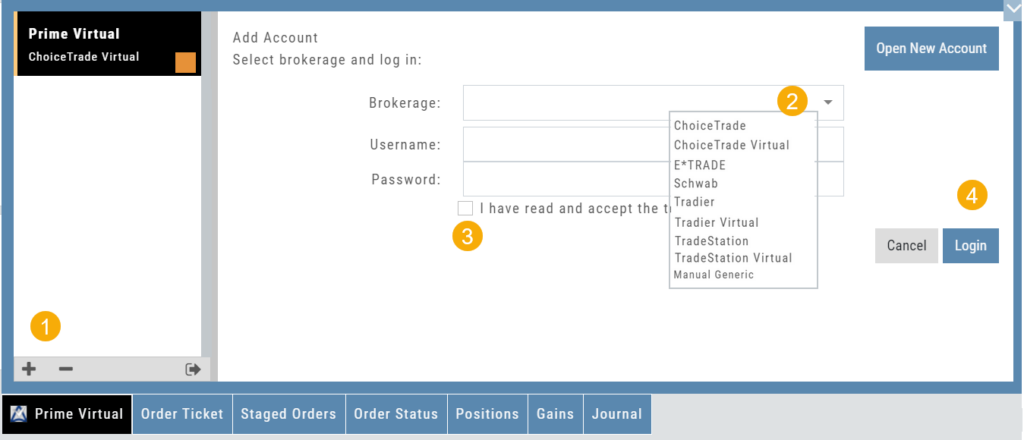

Adding an Account

Accessing a live account is easy. Currently Choice Trade, Tradier, Schwab, E*TRADE are offered through this platform. More brokerages will be added.

To add an Existing Brokerage Account or add a Virtual or Manual Account:

1. Clicking on the “+” icon will display the screen below

2. Select your Brokerage, Virtual or Manual Account from the drop-down

3. Read & Accept Terms and Conditions

4. Click “Continue”

Live Accounts will prompt you to enter your credentials on the next screen.

Virtual** and Manual Accounts will automatically activate.

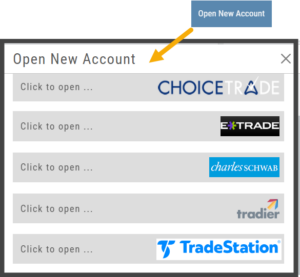

To add a New Live Account, click on the “Open New Account” box on upper right of the above screen.

To add a New Live Account, click on the “Open New Account” box on upper right of the above screen.

Select the account you want to add by clicking the selected brokerage.

Click the “Done” button.

You’ll be directed to the brokerage website to guide you through the process of completing an application.

**TradeStation requires a completed account application to create a Virtual Account.

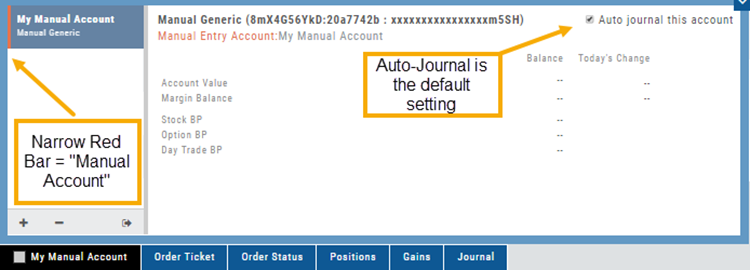

Manual Account Overview

A Manual Account is versatile resource tool which can enhance your trading effectiveness. You can also use this to track trades from an outside brokerage account.

Use the Manual Account for educational purposes.

- It offers flexibility and control, while providing the Analytics and Journal to help you reinforce the “Learning to Earning” process. This allows you to focus on learning the strategies.

- Place trades any time of day or night – all get immediately executed at the price entered. No need for the market to be open.

- No Buying Power limits – no expensive spread margin requirements to adhere to, no limit on how much you can buy/sell

- Place trades in the past.

- Enter trades from Backtest Mode

Use to tracking external accounts

- Can be used to track trades placed at brokers not integrated into the platform

- You can enter the date and fill prices of your actual trades

- This enables portfolio management along with your other accounts

- You can use full Journal function for tracking your progress

Manual Accounts are identified by a narrow Red Bar and are, by default, Auto-Journaled.

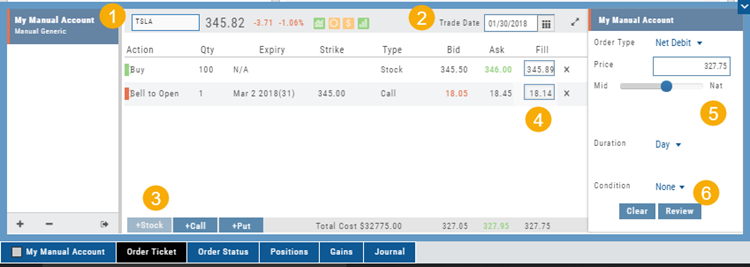

Entering trades in a Manual Account takes only a few steps and is similar to a regular trade.

You can also bring up the ticket from any trade point. Simply start a trade and select the manual account just like you would select any other account.

(Bold indicates unique to Manual ticket):

1. Enter the Stock Symbol, or name of Company (Smart search will display potential matches)

2. If this is a past trade, use the calendar/date picker to select date

3. Click “Stock”, “Call” or “Put” to build trade, change quantity, Expiry and Strike (if applicable)

4. Bid/Ask will automatically populate if a specific price is not entered

5. Complete Order Type, Duration and Condition

6. Click “Review” to confirm information is correct, then ‘Submit” on next screen.

The order will appear in Order Status as “Executed” and operate the same way as other accounts.

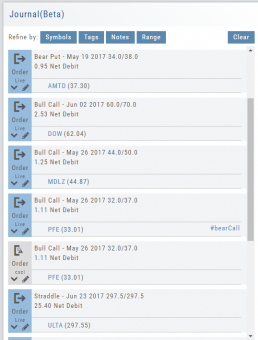

Journal Navigation

![]()

It’s easy to look up trades. Choose from Stock symbols, tags used (ex: #bullCall, #longStraddle), Notes containing certain words or phrases, or date ranges from 1 Day to 1 Year.

On the individual Trade tabs, click the ![]() icon to expand the trade detail. To edit/add tags, notes, to the trade entry, click

icon to expand the trade detail. To edit/add tags, notes, to the trade entry, click ![]() then ‘save’ when completed.

then ‘save’ when completed.

Once the Trade Tab is expanding , you have additional options: The “Replay” icon, ![]() , sends a trade from the Journal to Backtest Analysis. You can delete a Journal Entry by clicking on

, sends a trade from the Journal to Backtest Analysis. You can delete a Journal Entry by clicking on ![]() .

.

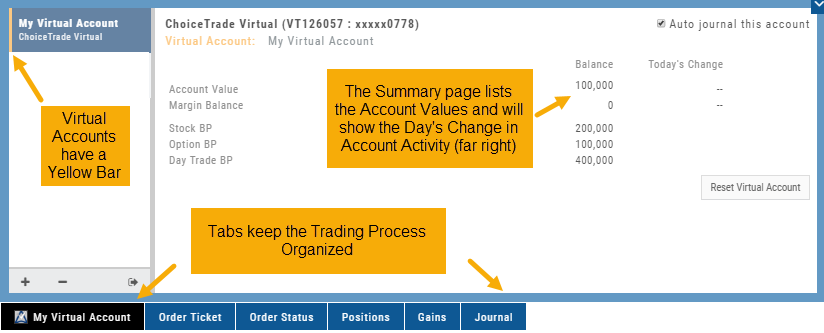

Virtual Account Overview

Virtual Trading gives you the real trading experience without risking any money. It is a valuable “next step” learning tool – designed to mimic the trading experience as closely as possible.

You’ll start with a $100,000 account. Virtual, of course.

Trades are executed during Market hours – 9:30 a.m. – 4 p.m. Eastern Time, however there is a 15 minute delay after Market open for orders to begin executing.

As with Live Accounts, there are limits on trades if there is not sufficient Buying Power in your Virtual Account. There can be expensive Spread/Margin Requirements to adhere to.

Virtual Accounts do have limitations that Live Accounts do not have:

Virtual Accounts are not subject or responsive to Corporate actions such as buyouts, name or symbol changes, stock/option splits and strike price adjustments to name some examples.

![]()

Virtual Accounts are “Auto-Journaled”. This automatically keeps record of all trades for later analysis and reconciling.

These practice accounts are identified by a yellow bar on the left side of the account window.

Virtual Accounts are powered by Choice Trade to provide the real trading experience.

Color Tag Trading Accounts

Select a unique color for each trading account on the Account Summary tab. Each trade in that account will display that color on the Journal trade tab entry.

Now it’s easier than ever to identify trades at a a glance.