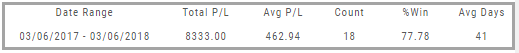

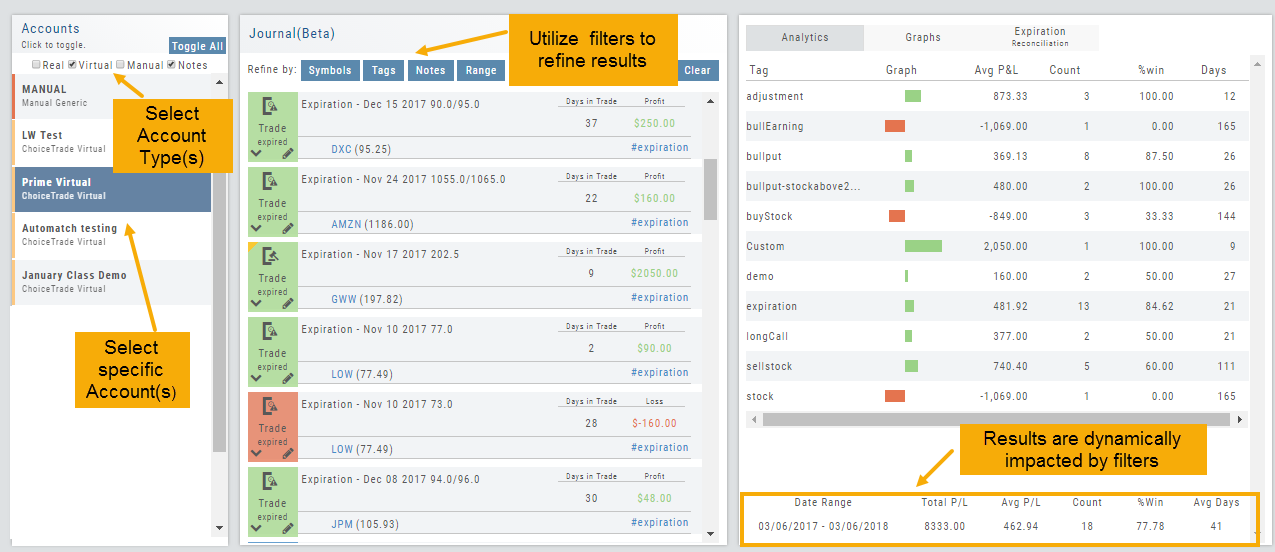

Tag Results-Table Summary Totals

Located below the Analytics Tab in the Journal, the Tag Result Table Summary displays trade performance by Date Range, Total P/L, Average P/L, Number of Trades (Count), % Profitable and Average Number of Days in Trades.

This data is dynamically updated by available filters including:

Type of account(s) (Manual, Virtual &/or Live)

Specific trading account(s)

Date Range

Stock symbol

Tags

Not only does this table provide valuable information, you can use it to compare strategies, track improvement in your overall trading, etc.

Insight Tab in Journal

The Insight Tab, along with Tags and Graphs update dynamically with the account(s), symbol(s), tag(s) and/or date range selected.

Insight breaks down Overall Performance by Winning and Losing trades in addition to:

- Number of closed trades

- Percent (Winning/Losing Trades)

- Total $ Profit/Loss

- Average Total Profit/Loss

- Biggest (Winning/Losing Trade)

- Average Days in Trade

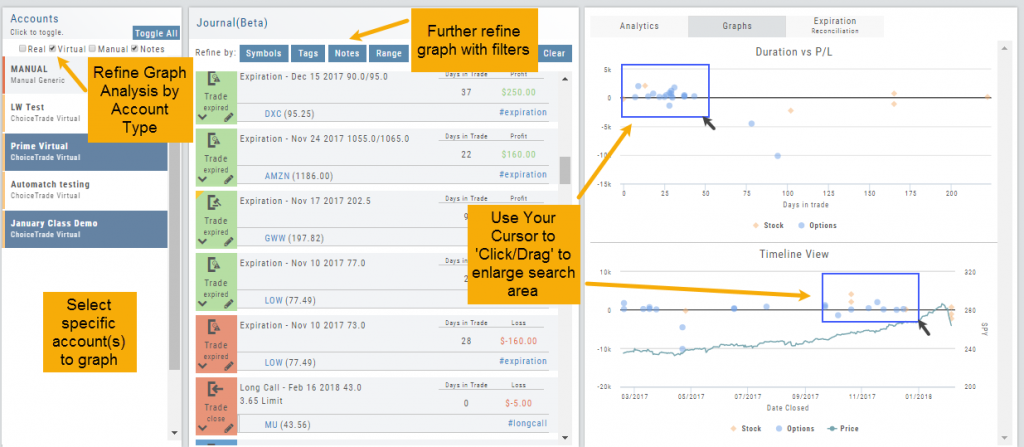

P/L & Duration/Timeline Graphs

Journal Trade Graphs

This tab offers two views of your Closed, Matched or Reconciled trades: P/L by Trade Duration and P/L by Timeline. The views update dynamically by Account, Symbols, Date Range and #tags.

The Timeline Graph.

Click/Drag your cursor to adjust/enlarge the orientation view.

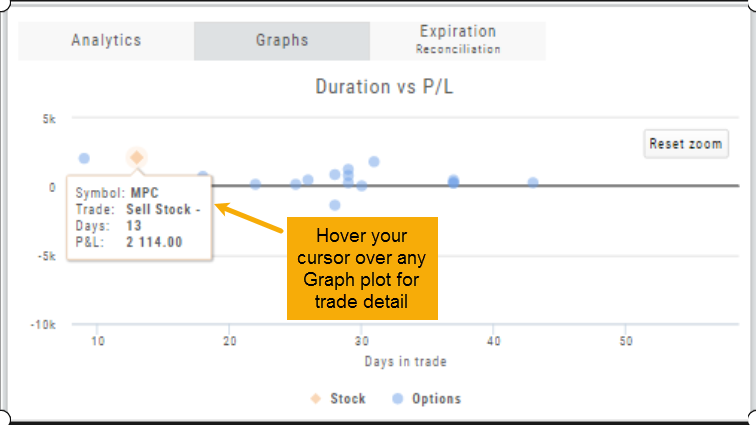

Hover your cursor over each graph plot for trade detail. Circles = Option Trades, Diamonds = Stock Trades. The Duration View shows P/L and # of Days in the Trade

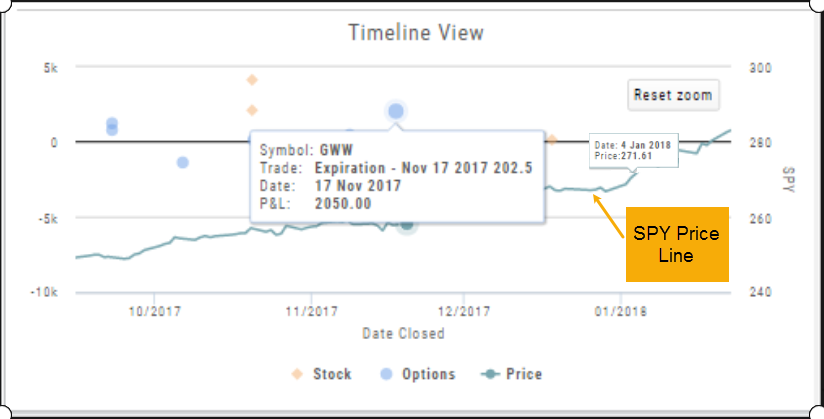

Timeline View displays P/L on Date Closed or Expiration

SPY Price is displayed on the Timeline View. Slide your cursor along this graph line to show end-of-day price for that date.

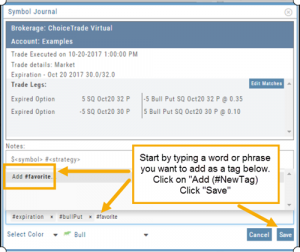

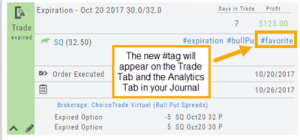

Add New #tags and Auto-Tagging

Trade Finder Scans have #tags that will automatically appear on the corresponding trade tabs in the Journal, such as #BullCall, #BullPut or #CoveredCall, for example. Trades built manually will default to #custom. In addition, trades that have expired will be auto-tagged: #expiration.

You can revise these tags and/or add your own, by the following steps:

1. On the Journal Tab, select the Trade entry you wish to edit by clicking on the Pencil Icon.

2. In the Tags section (lower part of box), start typing the word/phrase you wish to use. Example: favorite

(It is not necessary to enter the ‘#’ symbol first).

3. Click on “Add (#NewTag)“, then Save.

4. The new Tag will be on the individual Trade tab and the Analytics section of the Journal.

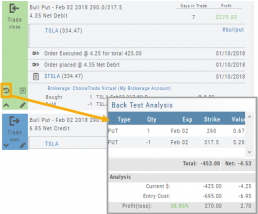

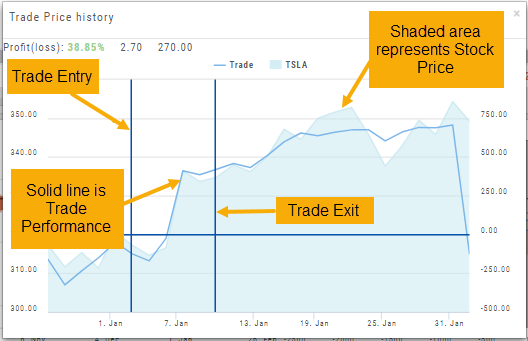

Backtest from the Journal

You can “Replay” a trade from your Journal by sending it to Backtest Analysis.

Click on the ![]() icon on the Journal trade tab.

icon on the Journal trade tab.

Trades are sent to the specific strategy template of the trade.

If you click on the “Trade Open” tab, you will only get that view of the trade.

View the P/L, Price History, Stock Volatility Chart – be sure to utilize the “Go Big” function to see more detail of the trade.

Click Here for more on Backtesting

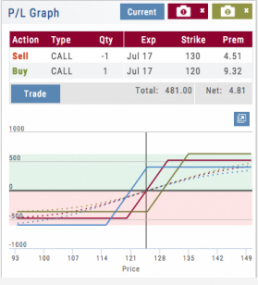

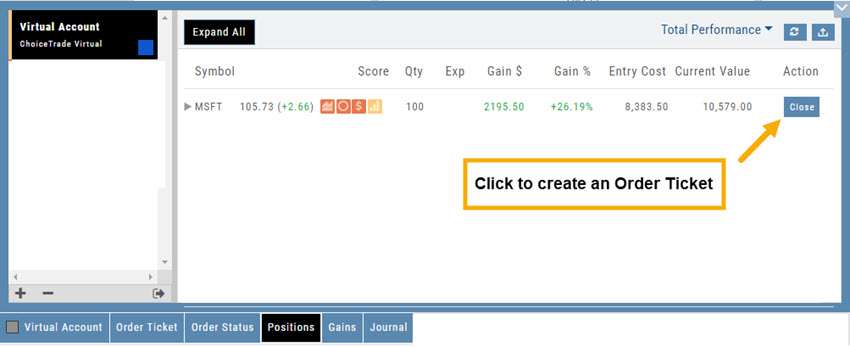

I own the stock, how to I enter a Covered Call trade?

When you already own the stock, but want to enter a Covered Call position, follow the following steps:

1. From the Positions Tab, click “Close”

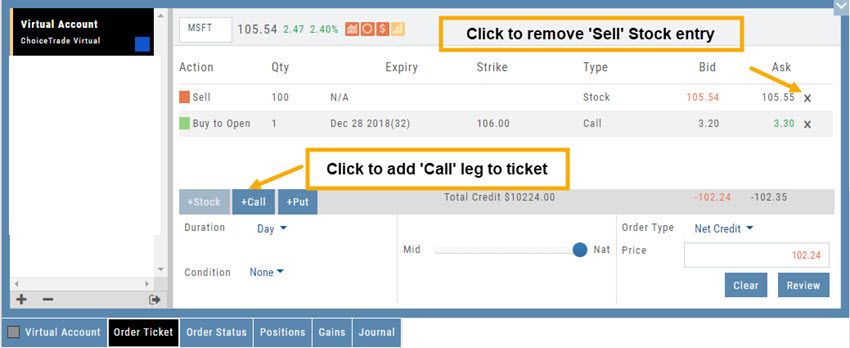

2. Add Call Leg (you’ll adjust this later) & Delete Sell Stock entry line:

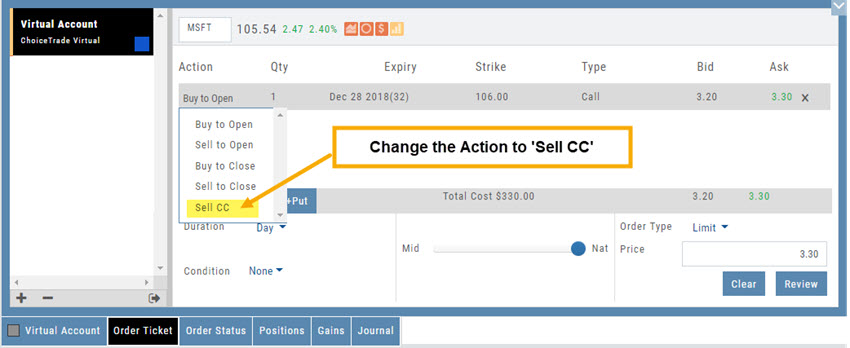

3. Change Action to Sell CC. Make any other adjustments to this Order Ticket, click “Review” to check for accuracy, then “Submit“.

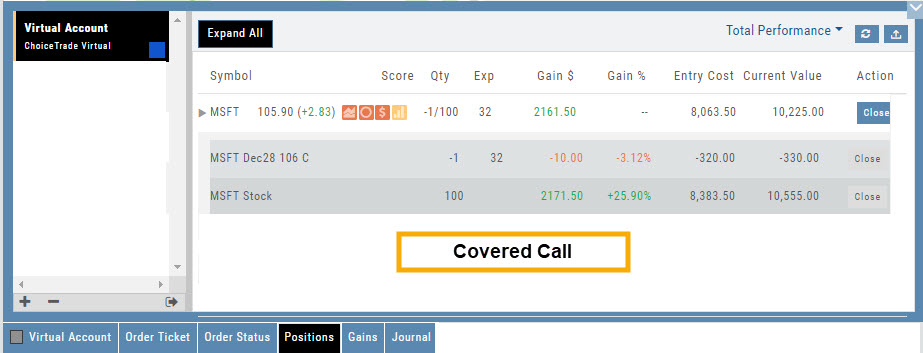

4. After the Order executes, it will show up in the Positions Tab as follows:

Save Backtested Trades to Manual Account

Want to keep record of backtested trades?

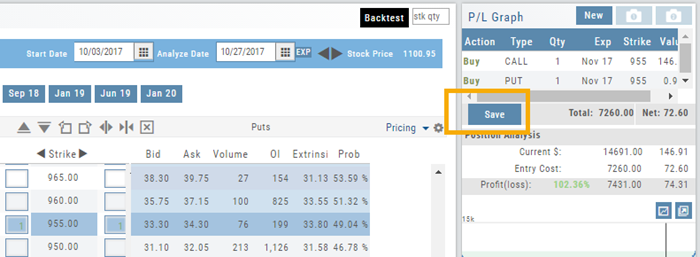

Send them to the Manual Account. While in Backtest Mode, structure your trade as usual in the Options Chain or in a Strategy Template. Then click “Save”.

The “Trade” button becomes “Save” when in Backtest Mode.

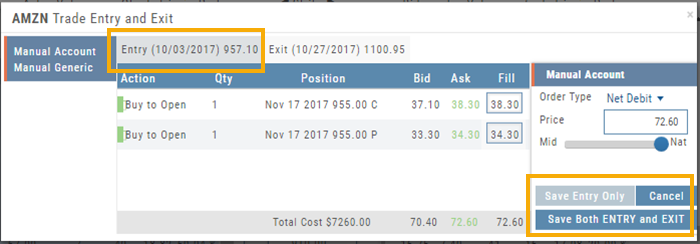

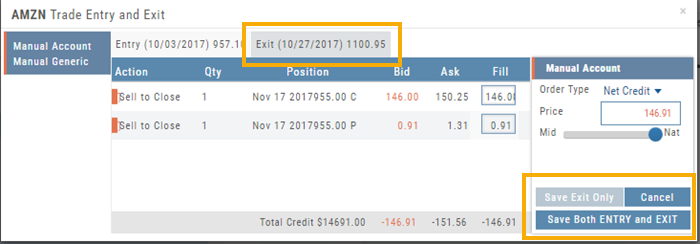

You have the option of saving the Entry or Entry and Exit of the trade. Each tab has specific information such as Total Cost when opening the trade and Total Credit (Debit) when Exiting the Trade.

You’ll have the option to Save both the Entry and Exit positions on the “ticket”. You can also choose to save only the Entry OR Exit if you wish. So if you want to post an opening trade on a past date, but still have it open now, you can Save Entry Only on the Entry part of the Ticket.

Journal too

Once saved, you can see these trades in your Journal. You can add notes and tags. Simply click Journal in Order Status, or edit in the Journal.

Delete Journal Entries

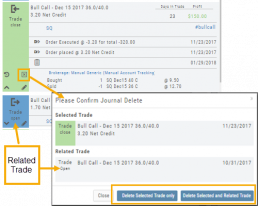

Whether you entered a trade incorrectly, or want to remove Cancelled Orders from your Virtual or Manual Account, you have the ability to delete a Journal Entry.

Simply expand the Trade tab and click on the ![]() icon.

icon.

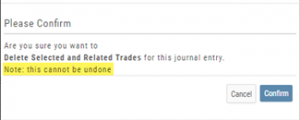

If you are deleting Cancelled or Expired orders, you’ll be prompted to confirm you want to delete the entry.

For trades that have a specific Open and/or a specific Close, you’ll be prompted to choose either Selected Trade or Selected and Related Trade, if applicable.

Prior to deleting your selection, you’ll be prompted to confirm the action. Once deleted, the trade cannot be restored.

Note: Deleting a Journal entry for a Manual Account will remove the trade completely from both the Journal and Manual Account.

Deleting a Journal entry for Real or Virtual Accounts only remove the Journal entry, and the trade will remain in the account.

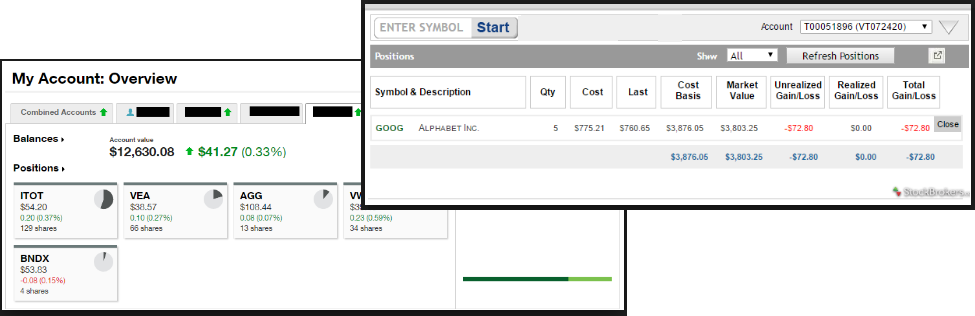

Account Differences Explained

When you set up your Live Account with TD Ameritrade, Choice Trade or other Brokerage you may notice account value differences on the Positions summary tab.

The Trade Tool Positions Account Values are tied to the Bid price (if you own a stock or option) and Ask price (if you are short a stock or option). Were you to close the position, you would receive the corresponding price – or better, since you are able to try to get a better price than Bid/Ask. This method ensures you will get at least the listed value – or better.

Choice Trade Accounts can be set up to have the price shown in the Positions Summary tied to the Bid/Ask or the default, “Last Trade Price“. Last Trade Price differs from Bid/Ask in that it shows the most recent transaction price, but does not always reflect the price you will receive if you were to buy or sell the security.

TD Ameritrade ties trade values to Mark – the point between Bid and Ask. Some trades will be closed at this price, but not all. Mark does not take into account if you own or are short a position, it is simply the halfway point between the two.