Key Ratio (formerly Valuation)

Key Ratio

A stock’s key ratios provide valuable insights into various financial aspects of the company. They are derived from the financial statements and help investors evaluate the company’s financial health, performance, and overall investment potential.

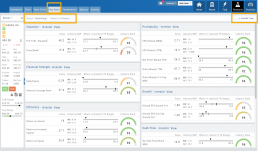

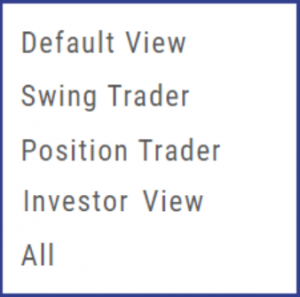

Assessing Key Ratios may vary by the type of trader one is: Growth Investors differ from Swing Traders who differ from Position Traders. The platform offers different views using Key Ratios for such scenarios.

Key Ratios allow you to not only view the company’s financial health but also view them in relation to others in the same industry, comparing ‘apples to apples’. Having this information allows you to better evaluate potential opportunities.

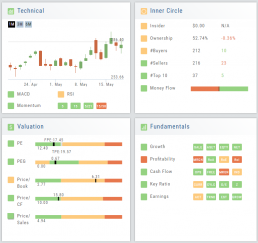

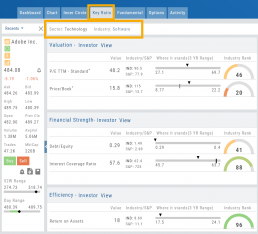

Deciphering the graphics

The illustrations show how to read the information provided as well as provide context on how the particular stock is performing to the Industry as well as the S&P.

Note: Depending on the Industry and/or S&P values, their tab(s) may not appear on the bar graph.

Select the view that matches your style of trading.

Just like trading, there is no ‘one-size-fits-all’. Those focusing on longer-term trades would not be interested in the same criteria as those who prefer shorter-term positions.

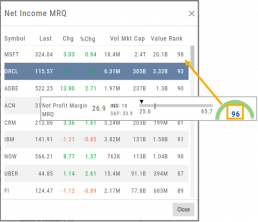

Clickable Key Ratio Value

View other industry stocks’ ranking by clicking on the numeric value as shown.

What does “N/A” or “–” indicate?

If a number does not appear in the Ratio criteria, you will see either a “N/A” or “—“

N/A indicates the datapoint is applicable, but the value not currently available

— indicates the data point does not apply, such as Inventory Ratios with Banks

Platform Features Release: July 2023

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process. These two areas of the platform have undergone a major redesign and expansion of metrics.

Key Ratio Tab(formerly Valuation)- Reworked and expanded data points offered as well as provided context of how well a stock is performing compared to its Industry and the S&P.

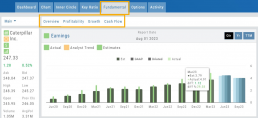

Fundamental Tab – Improved display of the expanded data available offer the ability to view fundamental metrics by Quarter, Year or Trailing Twelve Months (TTM) with the ability to adjust the time period and data display views.

Register for Office Hours, Wednesday, July 12th

Join us for a special Office Hours session, Wednesday, July 12th at 4:15 Eastern (15 minutes after Market Close)

Rance will be showcasing the Key Ratio and Fundamental tab data – how to read, understand and utilize the metrics provided.

Register using the button below. A confirmation email will be sent with a link to join for the scheduled time.

Key Ratio Tab

Key Ratio analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Key ratio indicators provide valuable information about a company’s financial health, profitability, growth prospects, operational efficiency, and overall value enabling traders to make more informed decisions:

Valuation: Helps determine whether a stock is priced attractively in relation to its earnings, sales, or book value.

Profitability: Signifies a company’s ability to generate returns for its shareholders.

Financial Strength: Assesses the ability to meet financial obligations and weather economic downturns.

Growth: Analyzes potential for expansion and increased earnings over time.

Efficiency: Measures how effectively a company utilizes its resources to generate output.

Cash Flow: Provides insights into the company’s ability to generate and manage cash.

Fundamental Tab

Fundamental Analysis involves a comprehensive examination of a stock’s financial health and its underlying value, as well as other relevant financial and non-financial metrics, to form an overall view of a company’s financial health and value.

This information is displayed in charts and graphs making it more useful in the analysis process.

It’s important to note that fundamental analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Enhancements

Price has been added to the Volatility Chart on the Option Chain display. Slide your cursor along the chart to display the Date, Price, HV & IV

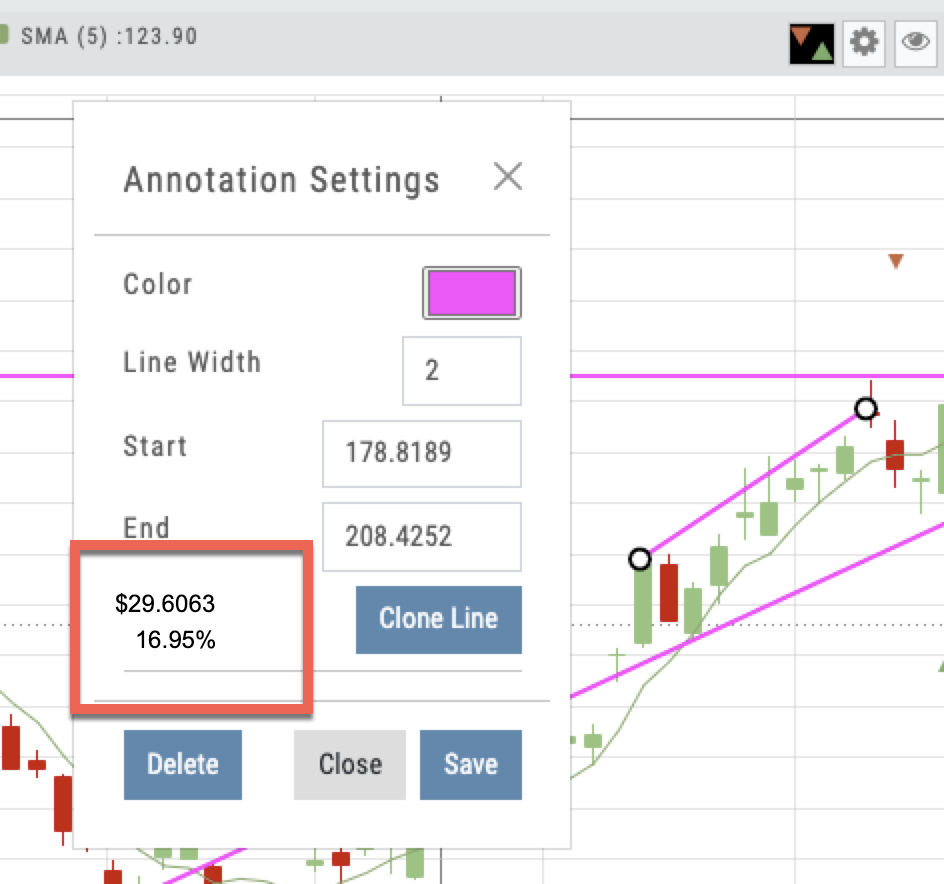

Dollar and Percentage Move added to Line Settings:

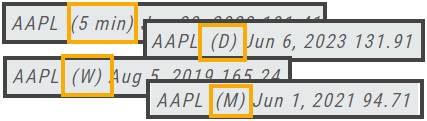

Timeframe displayed on chart when not on “Favorite”:

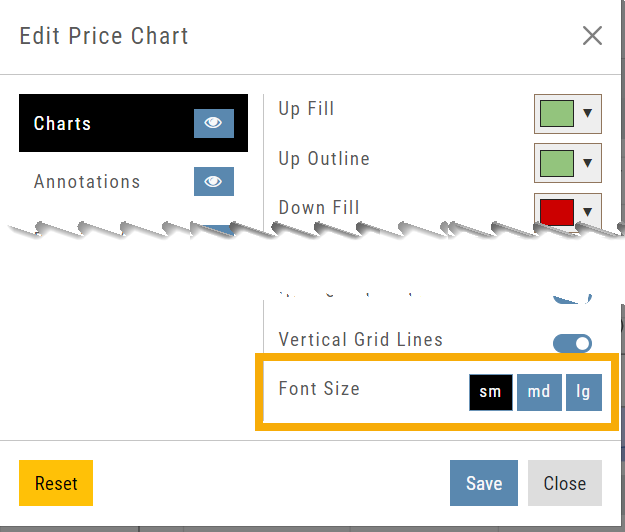

Font Size Selector for Price Chart

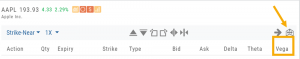

Vega added to Strategy Templates. Click the ‘expand’ icon, if needed:

Change Log

- Linear Regression Channel period number updating

- Roll-out time icon synced with Risk Graph

- Added “No or Limited Dividend Information” message

- Corrected Backtest Net Debit/Net Credit responsiveness

- Reset button function restored on Projected Price

Valuation

Is it Overvalued or Undervalued?

Valuation looks at Key Ratios and Projected Price to evaluate the stock’s current value.

Key Ratios like both trailing and forward PE along with PEG (Price/Earnings/Growth) are weighed.

The Price compared to Book (flow of business), Cash Flow, and Sales are also very important factors to provide a well-rounded synopsis of the valuation modeling of the stock.