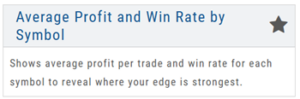

Journal Tab - Reports

Journal Reports

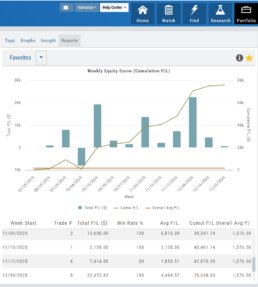

Understanding your trading performance shouldn’t require digging through spreadsheets or guesswork. Journal Reports turn your trading data into clear, visual insights—so you can quickly see what’s working, what’s not, and where to focus next.

With intuitive graphs and concise summary outlines, Journal Reports provide a high-level view of your account performance across multiple categories, helping you connect the dots between results, behavior, and decision-making.

Whether you’re reviewing weekly performance, refining your edge, or building better trading habits, Journal Reports transform raw data into actionable insight—at a glance.

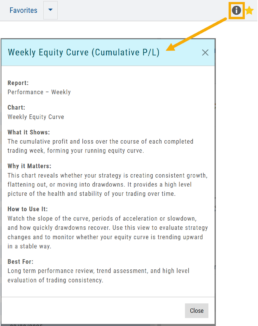

Click the Info Icon ![]() for a detailed outline on:

for a detailed outline on:

- What information the report provides

- Why it matters

- How to use it

- The application(s) the report is Best used for

Report Legend

Each Report has a legend where indicators can be toggled on/off simply by clicking on each one.

![]()

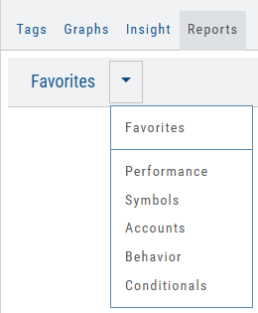

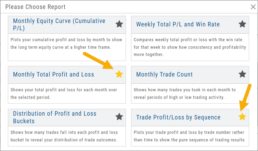

Journal Reports include insights by:

- Performance – Analyze results by time period to spot trends and consistency.

-

Symbols – Identify which tickers were your most and least profitable.

-

Account – Review performance across individual or multiple accounts.

- Behavior – See how trading habits impact outcomes.

-

Conditionals – Evaluate performance based on specific trade criteria or setups.

Click on one of the above categories, then click on the Report to display

To make analysis even easier, users can group their Favorites into a single section—allowing you to focus on the symbols, strategies, or reports that matter most to you.

Simply, click the Star Icon to highlighteach Report to keep under “Favorites”

- The account(s) selected on the left side of the Portfolio Tab display the activity in the center panel for the default time period of 12 months

- Use the Filter Button to adjust the time period, symbols, etc to display

- The results from the center panel will be displayed on the right panel

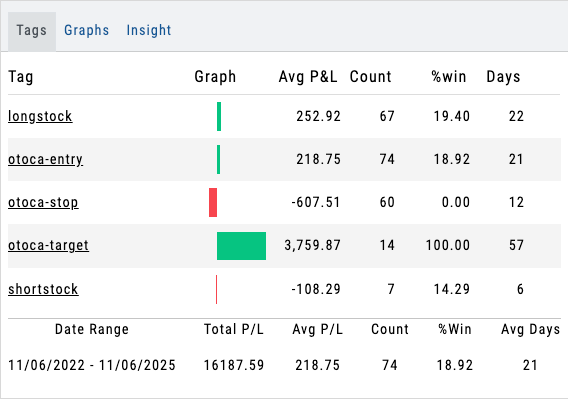

Journal Tagging - OCO, Trailing Stops, etc.

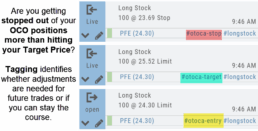

OCO Journal Tagging

OCO Orders are automatically tagged in the Journal.

Once the Stock Order is Executed (it is an active Position), the Limit and Stop orders are Live (active Orders for the duration selected: Day or GTC.)

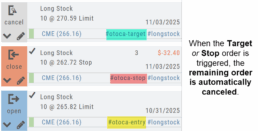

If/when the stock hits the Limit price, that order will execute, and the Stop order will be canceled. The Journal tab will be green and display a Gain/Profit.

-OR-

If/when the stock hits the Stop price, that order will execute and the Limit order will be canceled. The Journal tab will be red and display a Loss.

The tagged results show whether you’ve been hitting your target or getting stopped out.

**Note: Past Conditional trades will be tagged as “otoca-entry”, “otoca-target” and “otoca-stop”.

Trading Sandbox Account - Overview

Unlike traditional broker-provided virtual accounts, the Sandbox is not bound by brokerage margin rules or limitations, giving you more freedom to practice and test strategies.

Trading Sandbox Account was built specifically to overcome these shortcomings, allowing traders to:

-

Test advanced strategies without brokerage-imposed limits.

-

Gain confidence in how options positions will behave through expiration and assignment.

-

Track true results on completed trades for more effective learning and analysis.

As with other simulated trading systems, the Sandbox uses delayed market data. However, it goes beyond conventional paper trading platforms in several key areas:

Fast & Reliable Order Execution

Orders are processed quickly during market hours, creating a more realistic trading experience compared to laggy paper trading systems.

Supports Conditional Orders for Stocks

Effortlessly include Stop and Limit Orders when buying stock.

Options Handling That Works

Options are properly assigned and exercised as they would be in a real account, removing the gaps found in most brokerage simulators.

Accurate Trade Capture

The Sandbox records and captures gains/losses on completed trades, giving you a clear picture of how your strategies perform over time.

Full Journal Support

When auto-journaled (default setting) is set, all activity is captured. Track your progress to see what strategies work, what needs more practice, for important feedback.

How To Add:

Sandbox has been added as a drop-down selection in the Portfolio section of your trading platform

-

Click the bottom left corner tab of the platform to display all account tabs

-

Click the “+” icon appearing below these tabs

-

Select “Sandbox” from the dropdown list. Check the “I agree…” box

-

Name your account and select a color identifier, if desired.

-

Start trading!

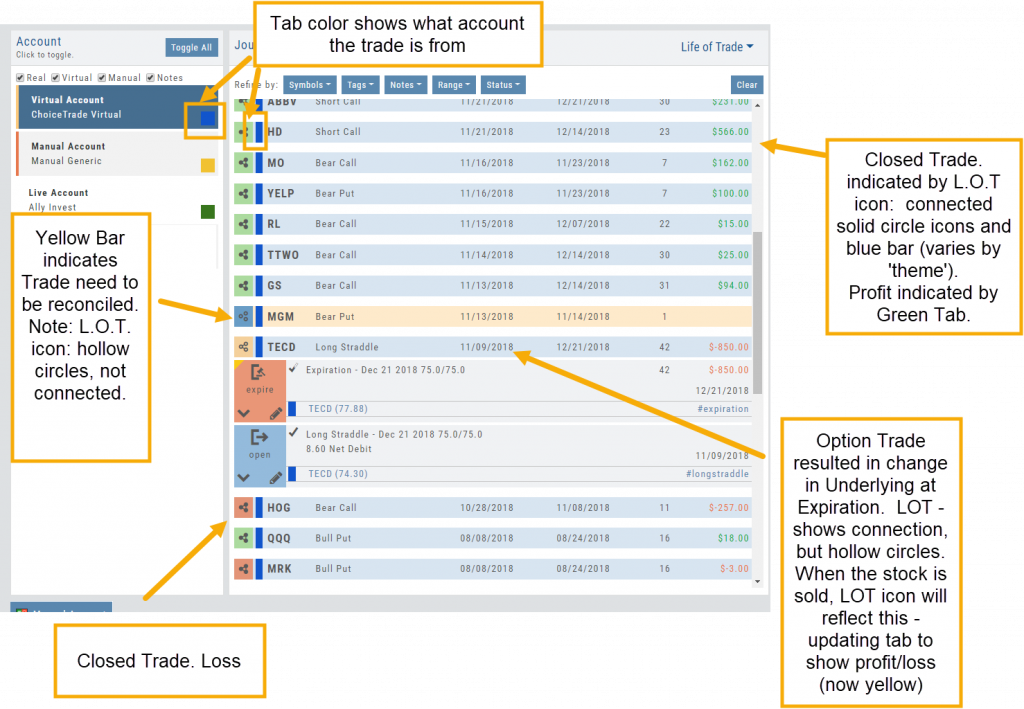

Life of Trade Journal View

Life Of The Trade

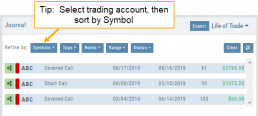

“Life of Trade” View in the Journal offers another way to view your trading activity and results.

Trades are grouped by Symbol, making it easier to follow the trade from Open-Adjust-Close – along with any Assigning/Exercising of the underlying stock.

This view further allows you to sort by Account, Symbol, etc for more targeted analysis.

Platform Features Release: December 2022

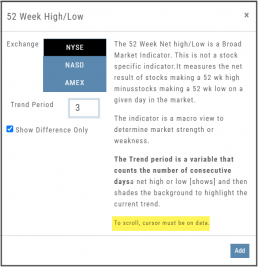

Announcing the latest Release which added a powerful Lower Indicator on the Charts Tab: 52 Week Hi/Lo. Price/Date info has been added to X/Y axis

52-Week Hi/Low Indicator

The newest lower indicator: 52-week Hi/Low Indicator is a Broad Market Indicator. It is not Stock specific.

View how individual Stocks/ETFs are faring compared to the Broad Market.

Select from NYSE, NASD or AmEx

There are two views:

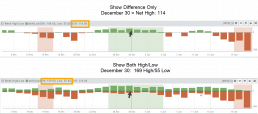

Show Difference Only – Display either a green or red (or no) bar representing the net advancers/decliners for that period.

Show High & Low (uncheck box)– Displays both green/red bars to illustrate number with new 52 week high/lows.

The background color identifies a bullish or bearish trend, based upon the number of days selected (Trend Period)

Example: If 3 days are selected, background highlight will begin on the 4th consecutive day of gains (or losses).

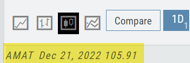

X/Y axis – Price/Date display

The cursor’s crosshairs will display the Price/Date info along the X/Y axis for easier reading.

This information will still appear in the upper/right corner above the chart:

Drawing Key Activation

Use your keypad to activate drawing lines on the Chart by following these steps:

1. Click either in Header area above the chart – OR –

Click the Annotation icon>Line

2. Click on chart, then “Alt” and “T” keys where you want to start line.

Once activated from either of the starting points (1), the function works on the current chart, without having to reactivate by clicking on the Header or Annotation icon.

Platform Features Release: November 2022

Announcing the latest Release allowing for customized Watchlist views. Improvements in Journal functionality will increase responsiveness and allow users to better control the data displayed. Format enhancements were also made to increase readability

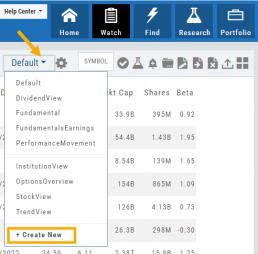

Watchlist Views – Create, Save & Edit

The ability to create your own Watchlist views based on criteria important to you enhances the work flow of finding the best candidates for trading.

Click on ![]() next to the (Default) Watchlist, then select “Add New” to get started.

next to the (Default) Watchlist, then select “Add New” to get started.

Build your own views from over 160 data points, then adjust the display position in the order you want them to appear.

Click on ![]() icon to edit a view you previously created.

icon to edit a view you previously created.

Learn more by clicking below:

Improvements

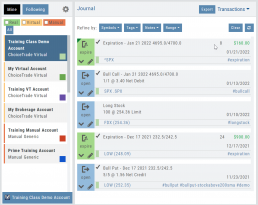

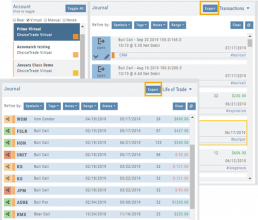

The Journal default displays Order/Trade activity from the Activated Trade Account.

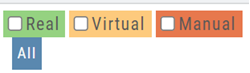

To switch or add accounts, simply click on the other Account tabs or select by group: Real, Virtual, Manual or All accounts.

The improved functionality allows for faster journal activity display and easier trade analysis.

Change Log

- Resolved Score Icon Navigation from Home/Market Tab

- Corrected Fundamental/Dividend missing data

- Moving Average indicator functionality restored on Custom Page

- Corrected display data on Fundamental Tab

- Addressed candlestick not appearing first 20 minutes on Mondays.

- Rectified downloading data from Screener

Set Up Trade & Journal Sharing (Premium Desktop Feature)

Trade and Journal Sharing

Step 1:

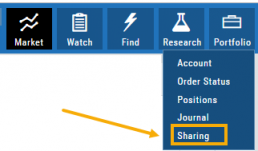

Select “Sharing” under the Portfolio Tab to to access these features of sharing trade ideas with peers or trading groups or have access to an Instructor’s Trades or Journal History.

Trade Sharing allows for potential trades to display in “Order Staging” listing the Source of the Order.

Journal Sharing can be used to follow a Trading Group, Instructors, Peer, Public Accounts as well as Newsletters/Trading Room applications.

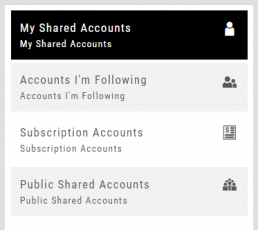

Step 2: On the left-hand panel, click on “My Shared Accounts”

Shared Accounts are grouped into 4 categories:

- My Shared Accounts – Elect to share Order Staging and/or Journal Sharing

- Accounts I’m Following – Other peers, trading partners, instructors

- Subscription Accounts – Newsletter or Trading Group applications

- Public Shared Accounts – allows access to a Public Directory with performance metrics

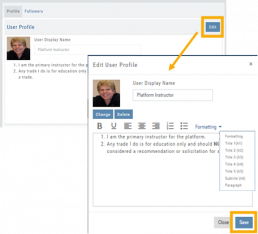

Step 3: Set up your User Profile

Click “Edit“

Add a User Display Name

Provide a Bio and/or Information about the account. This is what others will see.

The Formatting option allows you to customize the Bio/Information box.

Click “Save“

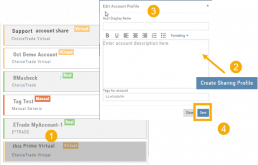

Step 4: Set Up Account Profile

1. In the middle panel, click on the Account to be shared

2. On the bottom right panel of the page, click on “Create Sharing Profile“

3. On the pop-up window, add an Account Display Name and Account Description.

Note: Both are required.

You are also able to add #tags to this Account Profile.

4. Click “Save“

Available buttons allow you to Generate New Code and Disable Code.

Account Options

Once Shared, you can “Unshare” account by clicking on button located in the upper right of this box.

Share Journal is checked by default.

Check box for Share Staged Trades if you wish to provide that on the selected account.

A code is automatically generated to Privately Share/Peer-to-peer share

Duration drop-down menu allows you to set how long the code is valid:

Single use only

Hour

Day

Week

Until Disabled

Export Reports (Desktop)

Clicking on ![]() located on the upper left corner of the Positions and Gains tabs allows you to export that information as a .csv file.

located on the upper left corner of the Positions and Gains tabs allows you to export that information as a .csv file.

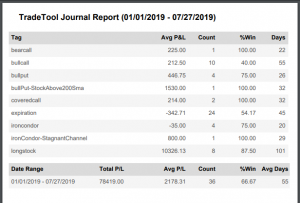

The Journal give you the ability to export reports in a PDF file on your desktop platform. But that’s just the beginning.

You can export from the Transaction or Reconciliation view filtered by Account, Symbol, Tags, Notes and/or Date Range.

Life of Trade View also allows you to filter by Order Status in addition to the above criteria for even more focused report. Only want to print Closed Trades? Want to see how many trades are Unmatched? Select those filters.

The top of your Journal report displays the Tag Summary based upon the account(s) and filtering criteria selected.

The trade detail report displays the status, Open, Close, Expire with a color code of the trade: Blue=Open, Green=Profit, Red=Loss, Yellow=Unmatched.

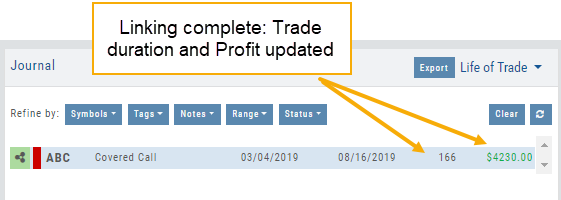

Link Trades in Journal

Trades can easily be linked in the Journal. This is helpful to keep related trades grouped together for easier tracking and analysis.

Some common applications include:

- Covered Calls – keeping stock and selling Calls with different Expirations

- Adjustment/Repair Trades

- Other previously Unmatched trades

This feature is best used in the Life of Trade View in the Journal.

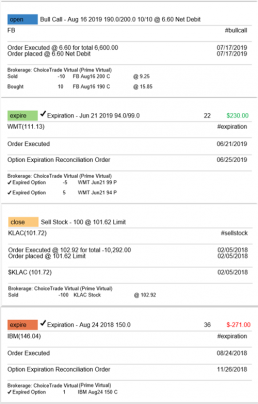

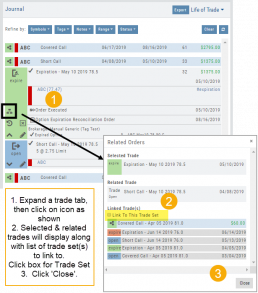

The following steps will allow you to Link Trades: ![]()

1. After selecting your account and sorting by symbol, expand one of the trade tabs you want to link to another trade group or set.

Click the ‘Link Icon‘

2. A pop-up window will list the Selected (Expanded) Trade, any related trade and Available Trade Sets for that symbol in that account.

Note: You can link trade sets both prior to and following your current, selected trade.

Example: You want to link a May 2019 expired Call to April 2019 and June 2019 Covered Call trade set.

3. Click “Link To This Trade Set” for trade set(s) to link selected trade to, then click “Close“.

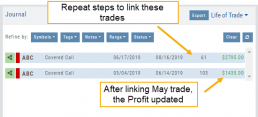

In this example, we linked an Expired May 10 2019 short call to an April and June Covered Call trade set.

After linking the trade, notice the total Profit (Loss) Amount updated, but the trade duration did not.

This is because the May Call falls in between the original April trade entry and the June expiration.

If you have more trade sets to link, repeat the previous steps as outlined.

Final note: If you link a trade in error, simply expand the same trade tab and ‘uncheck’ the Link This Trade Set box.

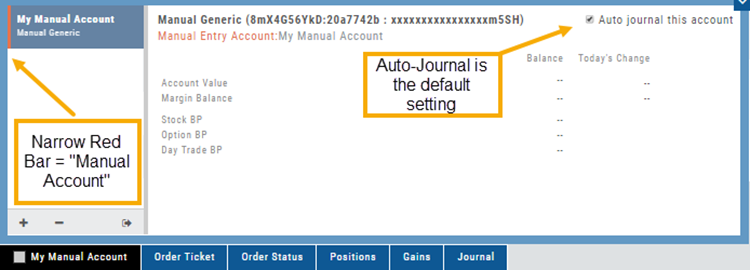

Manual Account Overview

A Manual Account is versatile resource tool which can enhance your trading effectiveness. You can also use this to track trades from an outside brokerage account.

Use the Manual Account for educational purposes.

- It offers flexibility and control, while providing the Analytics and Journal to help you reinforce the “Learning to Earning” process. This allows you to focus on learning the strategies.

- Place trades any time of day or night – all get immediately executed at the price entered. No need for the market to be open.

- No Buying Power limits – no expensive spread margin requirements to adhere to, no limit on how much you can buy/sell

- Place trades in the past.

- Enter trades from Backtest Mode

Use to tracking external accounts

- Can be used to track trades placed at brokers not integrated into the platform

- You can enter the date and fill prices of your actual trades

- This enables portfolio management along with your other accounts

- You can use full Journal function for tracking your progress

Manual Accounts are identified by a narrow Red Bar and are, by default, Auto-Journaled.

Entering trades in a Manual Account takes only a few steps and is similar to a regular trade.

You can also bring up the ticket from any trade point. Simply start a trade and select the manual account just like you would select any other account.

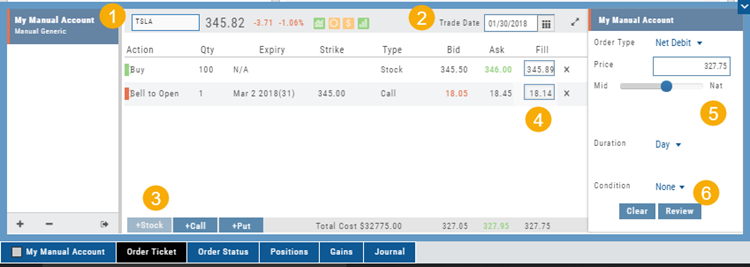

(Bold indicates unique to Manual ticket):

1. Enter the Stock Symbol, or name of Company (Smart search will display potential matches)

2. If this is a past trade, use the calendar/date picker to select date

3. Click “Stock”, “Call” or “Put” to build trade, change quantity, Expiry and Strike (if applicable)

4. Bid/Ask will automatically populate if a specific price is not entered

5. Complete Order Type, Duration and Condition

6. Click “Review” to confirm information is correct, then ‘Submit” on next screen.

The order will appear in Order Status as “Executed” and operate the same way as other accounts.