Journal Tagging - OCO, Trailing Stops, etc.

OCO Journal Tagging

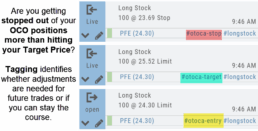

OCO Orders are automatically tagged in the Journal.

Once the Stock Order is Executed (it is an active Position), the Limit and Stop orders are Live (active Orders for the duration selected: Day or GTC.)

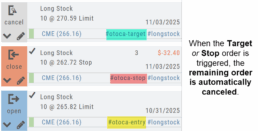

If/when the stock hits the Limit price, that order will execute, and the Stop order will be canceled. The Journal tab will be green and display a Gain/Profit.

-OR-

If/when the stock hits the Stop price, that order will execute and the Limit order will be canceled. The Journal tab will be red and display a Loss.

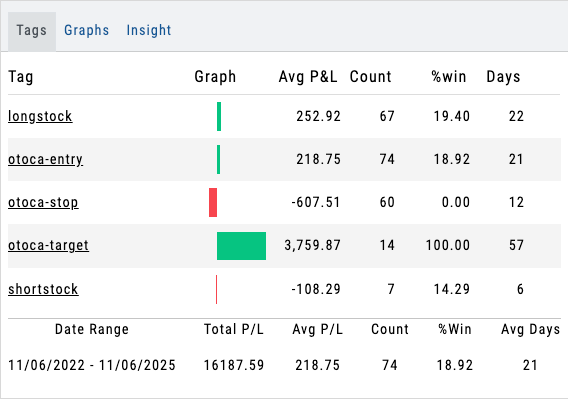

The tagged results show whether you’ve been hitting your target or getting stopped out.

**Note: Past Conditional trades will be tagged as “otoca-entry”, “otoca-target” and “otoca-stop”.

Conditional Orders (OCO)

Conditional Orders Available with Tradier Brokerage

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

Such orders offer ways to take profits off the table while limiting exposure to losses.

-

- Opening Order OR the existing Position to Close

- Select “Bracket (OCO)”

- If the trade is favorable, the Limit Price will trigger to close and secure profit.

- If the trade is unfavorable, this Stop (or Stop Limit) Order can limit your loss

- Duration: “Day” or “Good Til Canceled”

- Summary of the Bracket-OCO Order

- Review for accuracy, then Submit on the next screen