Trade from the Chart

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

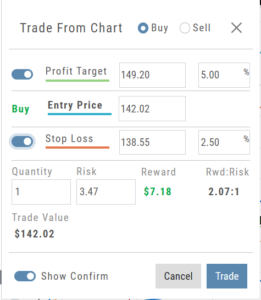

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

Show Order Status (Go to Order Ticket)

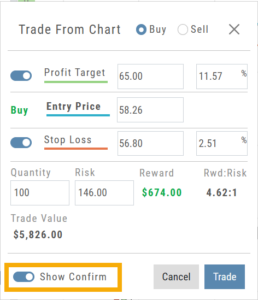

When trading from the Chart (OCO orders), you can elect to Show Confirmation – or not.

Toggling “On” will take you to the Order Ticket to review and submit your Order to the supporting brokerage.

Additional edits and staging the order are enabled with this selection.

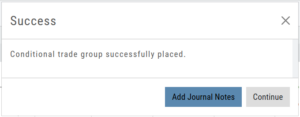

Once reviewed and submitted, you’ll get a confirmation that the order was submitted, as shown here:

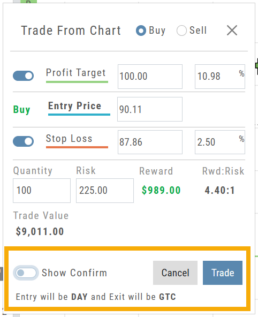

Toggling “Show Confirm” to Off, will bypass the Order Ticket window and convert the “Trade from the Charts” action to an Order Ticket itself.

Notice: The Entry is a Day Order, the Exit is a GTC order

Clicking “Submit” will send the order directly to the supporting brokerage.

Since the “Order Ticket” is bypassed, this order cannot be further edited or Staged.

Once submitted, as with “Show Confirm” activated, you’ll see this notice:

Conditional Orders (OCO)

Conditional Orders Available with Tradier Brokerage

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

Such orders offer ways to take profits off the table while limiting exposure to losses.

-

- Opening Order OR the existing Position to Close

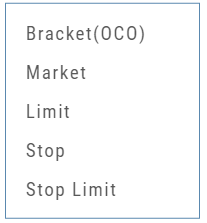

- Select “Bracket (OCO)”

- If the trade is favorable, the Limit Price will trigger to close and secure profit.

- If the trade is unfavorable, this Stop (or Stop Limit) Order can limit your loss

- Duration: “Day” or “Good Til Canceled”

- Summary of the Bracket-OCO Order

- Review for accuracy, then Submit on the next screen

Platform Features Release: Compare and AI capability added, Tradier Streaming

Join us Wednesday, October 25th for a special Office Hours session for an in-depth review session of the newest enhancements to your platform.

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process.

Research Tab/Dashboard:

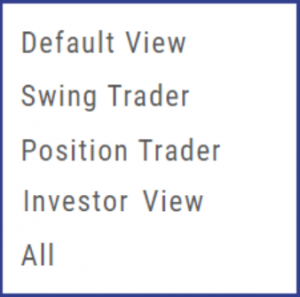

Compare Tab: Provides an at-a-glance comparison of competitors of the same industry group with the ability to change symbols and Swing, Position, or Investor views (also “All” and “Default”)

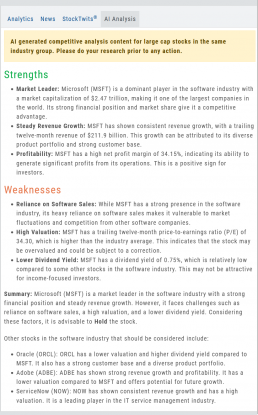

AI Analysis – AI generated competitive analysis for Large-cap stocks in the same industry group.

Compare Tab

The Compare feature, found under the Research Tab, allows investors to review a particular stock against its industry peers. Different Views offer Investors perspectives with different investment strategies, such as value or growth investing, to identify stocks that align with their preferred strategies within a specific industry.

Some of the Compare benefits include:

- Relative Valuation: Ratios like price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) can be assessed whether a stock is overvalued or undervalued relative to its peers.

- Identifying Outliers: If a company has significantly different ratios compared to its peers, it may warrant further investigation to reveal potential investment opportunities or risks.

- Industry Trends: Analyzing ratios across an industry can reveal trends and patterns. For example, if the majority of companies in an industry experience a declining profit margin, it may indicate a broader industry challenge or trend.

- Risk Assessment: Comparing key ratios can help assess the financial health and risk profile in an industry context. Companies with lower debt-to-equity ratios, for instance, may be considered less risky, especially if this trend holds across the industry.

- Operational Efficiency: Comparing Ratios like return on equity (ROE) and return on assets (ROA) among industry peers can provide insights into a company’s operational efficiency.

NOTE:

While comparing key ratios within an industry offers valuable insights, it’s VITAL to consider other factors , such as the company’s business model, competitive advantages, management quality, macroeconomic conditions, etc. Ratios should be only part of a broader analysis to make well-informed investment decisions.

The fields automatically populate with industry peers. They can be changed to compare other symbols of your choice.

AI Analysis

Located within the Activity Tab in Research, Stock AI analysis has the potential to enhance and streamline the process of evaluating and trading stocks in the financial markets.

Stock AI analysis can quickly process and analyze vast amounts of financial data, news, and market sentiment in real-time. This enables investors and traders to make more informed decisions based on a comprehensive view of the market.

Click on the AI Analysis Tab for the current symbol you are viewing. A progress bar will appear while the information loads for the initial session view only. The information will remain even if you log out and back in again during the same Market Day.

It’s important to note:

While Stock AI analysis offers these benefits, it also comes with challenges and risks, such as overreliance on algorithms, potential biases in data, and the need for continuous monitoring and oversight. Investors and traders should use AI analysis as a tool to complement their decision-making process rather than relying solely on it.

Streaming Quotes with Tradier

Your Tradier Account offers Real-Time Streaming Quotes!

Simply log in to your Tradier account from the platform, and you’ll see the Real-Time quote updates without having to change screens or refresh your browser!

Change Log

- At-the-Money Strike price bolded on Templates

- Long Butterfly template error corrected

- Resolved slider bar/template editing functioning

- Event flag display function preserved

- Slider bar function corrected on template page

Key Ratio (formerly Valuation)

Key Ratio

A stock’s key ratios provide valuable insights into various financial aspects of the company. They are derived from the financial statements and help investors evaluate the company’s financial health, performance, and overall investment potential.

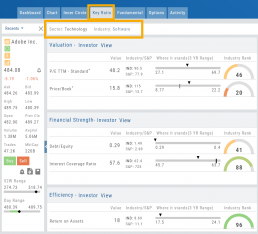

Assessing Key Ratios may vary by the type of trader one is: Growth Investors differ from Swing Traders who differ from Position Traders. The platform offers different views using Key Ratios for such scenarios.

Key Ratios allow you to not only view the company’s financial health but also view them in relation to others in the same industry, comparing ‘apples to apples’. Having this information allows you to better evaluate potential opportunities.

Deciphering the graphics

The illustrations show how to read the information provided as well as provide context on how the particular stock is performing to the Industry as well as the S&P.

Note: Depending on the Industry and/or S&P values, their tab(s) may not appear on the bar graph.

Select the view that matches your style of trading.

Just like trading, there is no ‘one-size-fits-all’. Those focusing on longer-term trades would not be interested in the same criteria as those who prefer shorter-term positions.

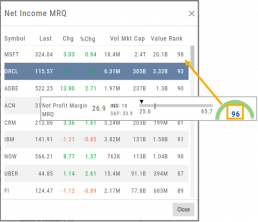

Clickable Key Ratio Value

View other industry stocks’ ranking by clicking on the numeric value as shown.

What does “N/A” or “–” indicate?

If a number does not appear in the Ratio criteria, you will see either a “N/A” or “—“

N/A indicates the datapoint is applicable, but the value not currently available

— indicates the data point does not apply, such as Inventory Ratios with Banks

Platform Features Release: July 2023

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process. These two areas of the platform have undergone a major redesign and expansion of metrics.

Key Ratio Tab(formerly Valuation)- Reworked and expanded data points offered as well as provided context of how well a stock is performing compared to its Industry and the S&P.

Fundamental Tab – Improved display of the expanded data available offer the ability to view fundamental metrics by Quarter, Year or Trailing Twelve Months (TTM) with the ability to adjust the time period and data display views.

Register for Office Hours, Wednesday, July 12th

Join us for a special Office Hours session, Wednesday, July 12th at 4:15 Eastern (15 minutes after Market Close)

Rance will be showcasing the Key Ratio and Fundamental tab data – how to read, understand and utilize the metrics provided.

Register using the button below. A confirmation email will be sent with a link to join for the scheduled time.

Key Ratio Tab

Key Ratio analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Key ratio indicators provide valuable information about a company’s financial health, profitability, growth prospects, operational efficiency, and overall value enabling traders to make more informed decisions:

Valuation: Helps determine whether a stock is priced attractively in relation to its earnings, sales, or book value.

Profitability: Signifies a company’s ability to generate returns for its shareholders.

Financial Strength: Assesses the ability to meet financial obligations and weather economic downturns.

Growth: Analyzes potential for expansion and increased earnings over time.

Efficiency: Measures how effectively a company utilizes its resources to generate output.

Cash Flow: Provides insights into the company’s ability to generate and manage cash.

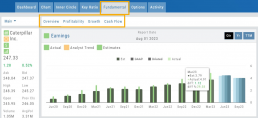

Fundamental Tab

Fundamental Analysis involves a comprehensive examination of a stock’s financial health and its underlying value, as well as other relevant financial and non-financial metrics, to form an overall view of a company’s financial health and value.

This information is displayed in charts and graphs making it more useful in the analysis process.

It’s important to note that fundamental analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Enhancements

Price has been added to the Volatility Chart on the Option Chain display. Slide your cursor along the chart to display the Date, Price, HV & IV

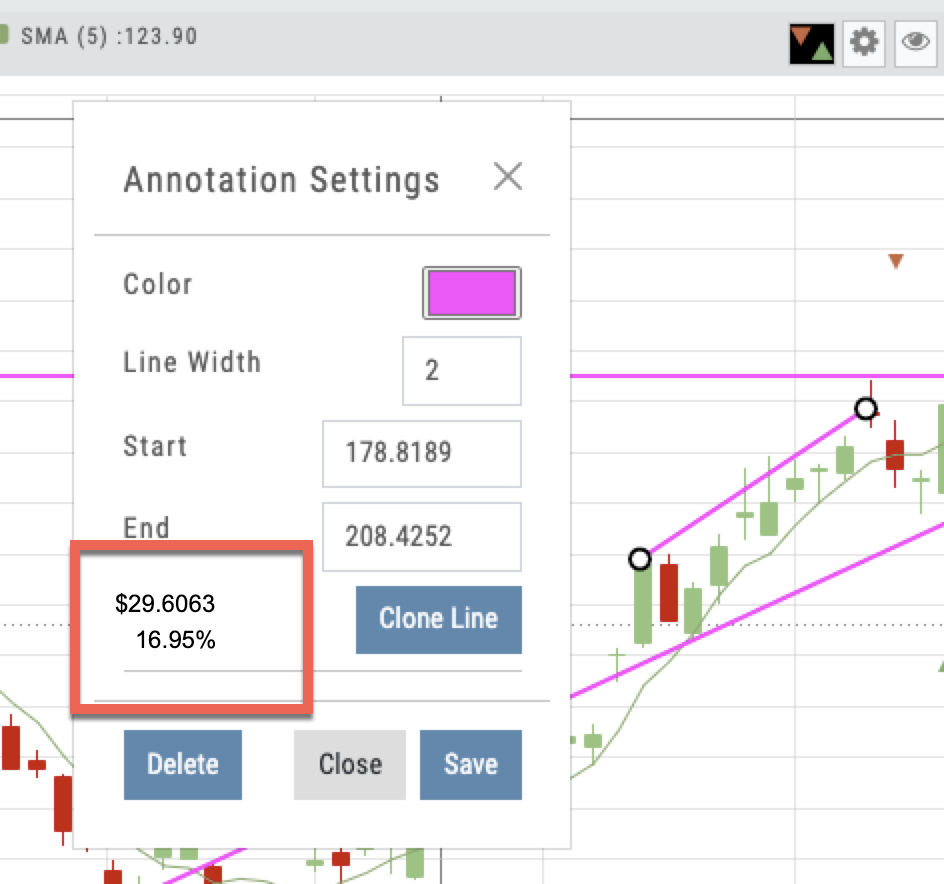

Dollar and Percentage Move added to Line Settings:

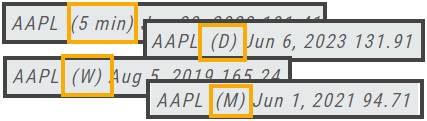

Timeframe displayed on chart when not on “Favorite”:

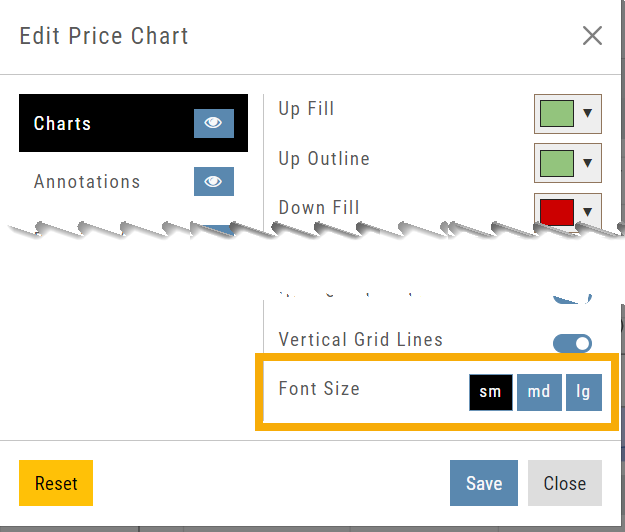

Font Size Selector for Price Chart

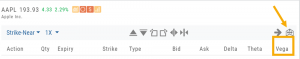

Vega added to Strategy Templates. Click the ‘expand’ icon, if needed:

Change Log

- Linear Regression Channel period number updating

- Roll-out time icon synced with Risk Graph

- Added “No or Limited Dividend Information” message

- Corrected Backtest Net Debit/Net Credit responsiveness

- Reset button function restored on Projected Price

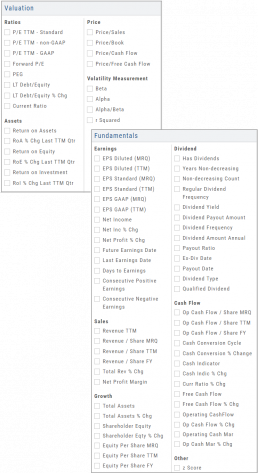

Fundamentals Tab

Fundamentals

Fundamentals provide valuable insights into the financial health and performance of a company. They offer a comprehensive analysis of the company’s operations, profitability, growth potential, and overall stability.

Fundamentals are comprised of Earnings, Dividends, Price Projections, Profitability, Growth, and Cash Flow.

Profitability, Growth, and Cash Flow offer even more detail. Either click the button in that section:

![]()

OR click the appropriate category at the top of the window:

Earnings data provide insight into a company’s financial health and performance.

Past earnings reports offer insight into the company’s historical growth, profitability, and stability. Positive earnings trends may indicate a well-performing company. Negative or declining earnings could be cause for concern.

Earnings

Earnings projections provide forecasts of a company’s future earnings to gauge Market sentiment and investor expectations. Projections are compiled by financial analysts using factors such as industry trends, company guidance, and economic conditions. Surpassing or falling short of projections can greatly impact stock price.

Some benefits to both the company and shareholders include:

Income Generation

Shareholder Loyalty

Return on Investment

Dividend Reinvestment

Signal of Financial Health

Possible Tax Advantages

Disciplined Capital Allocation

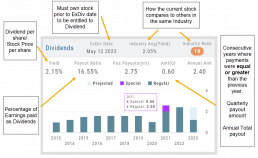

Dividends

The decision to pay dividends is up to the company’s management and board of directors, who weigh various factors, including the company’s financial position, growth prospects, and other capital allocation priorities. Dividend payouts are not guaranteed and may fluctuate or be suspended based on the company’s circumstances and strategic considerations.

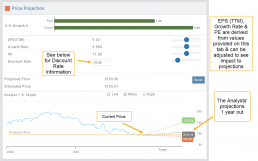

Price Projection

Discount Rate

Determining the appropriate discount rate for a stock is a subjective process and depends on various factors.

Here is an example:

- Risk-Free Rate: Start by considering the risk-free rate, (the theoretical rate of return on a risk-free investment such as government bonds). This serves as a baseline for the discount rate. An online search can locate this information for you.

- Risk Premium: Assess the risk associated with the specific stock you are evaluating. Stocks are inherently riskier than risk-free investments, so you need to add a risk premium to the risk-free rate. The risk premium accounts for the additional return expected by investors for taking on the extra risk. The risk premium can vary depending on factors such as industry, company-specific risks, economic conditions, and market volatility.

- Beta: This measures its sensitivity to market movements.

Beta of 1 = the stock moves in line with the overall market

Beta > 1 = the stock has higher volatility and would warrant a higher discount rate to reflect the increased risk. - Company-Specific Factors: Are there unique company factors (financial health, competitive position, growth prospects, management quality, etc) that could positively or negatively influence the discount rate?

- Sensitivity Analysis: Changing the discount allows you to assess the impact of the stock’s valuation. Some sectors are subject to more volatility than others: the Energy and Material Sectors tend to be more volatile than Consumer Staples or Utility Sectors.

The discount rate is subjective. Different investors might have different views on what the appropriate discount rate is for a given stock, based on their own risk tolerance, the specific risks associated with the company, and their expectations for future market conditions.

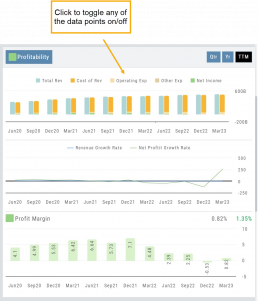

Profitability

Revenue: Money generated from sales of goods or services. It is income earned prior to deducting expenses or costs

Cost of Revenue: Expenses directly related to production, manufacturing, or acquisition of products/services sold. Typical examples include raw materials, labor, overhead, etc.

Operating Expenses: Day-to-day, necessary operating expenses not directly related to the production/acquisition of goods/services. Examples: Wages, utilities, depreciation, advertising, etc.

Other Expenses: Depending on the nature of the business can include: Taxes, Interest, Non-operating losses, Restructuring, Non-recurring, etc.

Revenue Growth Rate: Percentage change (+/-) in a company’s sales/revenue over a period of time:

Revenue Current–Revenue Previous/Revenue Previous x 100

Net Profit Growth Rate: Percentage change (+/-) in a company’s net profit over a specific period of time:

Net Profit Current–Net Profit Previous/Net Profit Previous x 100

Profit Margin: Percentage of revenue a company retains after deducting all expenses.

A higher profit margin indicates a company is generating more profit relative to its revenue. A lower percentage suggests higher expenses in proportion to revenue.

Growth

Asset: These can vary by industry/company. Common examples that contribute to a company’s growth are Financial, Intellectual Property, Human Capital, Physical Assets, Technology/Info Systems, Customer Base, Brand Equity, Partnerships, and Networks.

Debt/Equity Ratio: Total Debt divided by Total Equity. Interpretation varies by industry and a company’s specific circumstances: a high ratio can indicate higher financial risk OR effective management of debt through cash flow. A low ratio can indicate a conservative financial position OR under-utilization of debt and missed opportunities for growth.

Non-Current Assets: Resources not intended to be converted into cash or used up within a year.

Assets: Anything of value that has the potential to generate future economic benefits.

Liabilities: Obligation or debt a company owes to external parties that must be fulfilled in the near future.

Long-term Liabilities: Obligation or debt a company owes but has more than a year to repay.

Equity: The portion of a company’s value belonging to its owners or shareholders after all debts and obligations have been settled

Operating Cash Flow: Represents the cash inflow/outflow directly related to day-to-day activities including sales of goods and services, paying operating expenses, and collection of receivables.

Free Cash Flow: Cash flow available for discretionary use after accounting for operating expenses, capital expenditures, and changes in working capital. Positive values offer opportunities, negative values may indicate financial challenges.

Cash Flow

Cash Margin %: Percentage of cash generated from a company’s sales revenue after deducting its cash operating expenses. It measures the profitability and efficiency of a company’s operations to generate cash.

Cash Indicator: The industry percentile ranking of a company’s ability to generate cash from its operations.

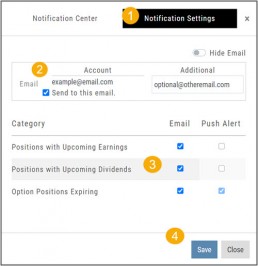

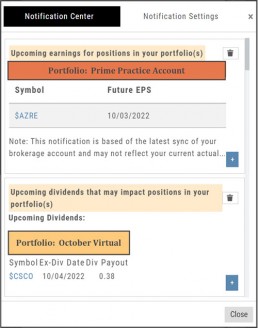

Position Notifications

When you Enable and Activate Account Notifications, you’ll receive emails on upcoming activity that may affect your existing positions.

- Upcoming Earnings – Monday Morning via Email

- Upcoming Dividends – Monday Morning via Email

- Option Position Expiring – Two days prior via Email

To begin, locate and click on the Envelope Icon at the top of the platform page, next to your Username:

![]()

Follow the steps as outlined and illustrated:

- Click on Notification Settings

- Add your email (Optional: Add 2nd email)

- Check/uncheck Categories

- Click “Save”

The settings can be updated at anytime by following the above steps.

Next:

For each account you want to receive notifications on, toggle the switch located on the Account Summary tab to the “On” position as shown in the graphic.

**Without this step, you won’t receive the notifications.**

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Platform Features Release: March 2023

Announcing the latest features/functions updates, additions, or edits to the trading platform:

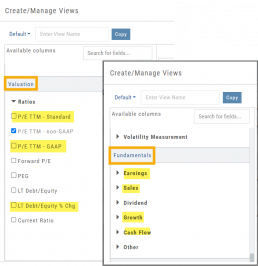

Valuation and Fundamental Data Points added

Users have more criteria to select from for both the Screener, to find potential trade candidates, and Watchlist Views to analyze candidates.

Valuation and Fundamental Data Points Added

Watch List Views

Over 30 data points were added to the Valuation and Fundamental sections for Watch List Views.

Build, Save, and Edit your customized Watch List Views to your needs.

Learn how to use this feature:

Screener

Over 30 data points have been added to the Screener Function under the Valuation and Fundamental sections.

There are 3 Levels of Data Points. Level 2 has more Data Points than 1, Level 3 has all criteria available to select from.

Now users have more tools to choose customize screens. These may be saved and edited at any time.

Enhancements

- Added Average Volume line to (upper) Volume Indicator

- Saving Annotations/Texts, etc on charts are an automatic function. It no longer has to be selected.

- Scroll function added to lists on Custom, Market and Watch pages

- GAAP/non-GAAP PE/PEG (TPE and PE chart in Valuation section to reflect GAAP PE)

Change Log

- Resolved Screener Export Function

- Open/Close “save” function fixed in Backtest mode

- 2nd email saving in Notification feature setup

- Candlesticks and Volume bars line up

Platform Features Release: December 2022

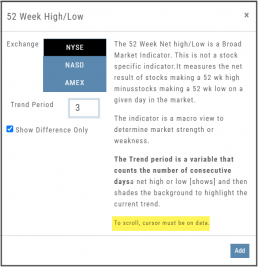

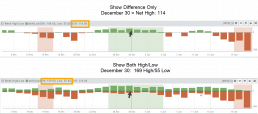

Announcing the latest Release which added a powerful Lower Indicator on the Charts Tab: 52 Week Hi/Lo. Price/Date info has been added to X/Y axis

52-Week Hi/Low Indicator

The newest lower indicator: 52-week Hi/Low Indicator is a Broad Market Indicator. It is not Stock specific.

View how individual Stocks/ETFs are faring compared to the Broad Market.

Select from NYSE, NASD or AmEx

There are two views:

Show Difference Only – Display either a green or red (or no) bar representing the net advancers/decliners for that period.

Show High & Low (uncheck box)– Displays both green/red bars to illustrate number with new 52 week high/lows.

The background color identifies a bullish or bearish trend, based upon the number of days selected (Trend Period)

Example: If 3 days are selected, background highlight will begin on the 4th consecutive day of gains (or losses).

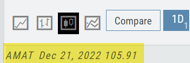

X/Y axis – Price/Date display

The cursor’s crosshairs will display the Price/Date info along the X/Y axis for easier reading.

This information will still appear in the upper/right corner above the chart:

Drawing Key Activation

Use your keypad to activate drawing lines on the Chart by following these steps:

1. Click either in Header area above the chart – OR –

Click the Annotation icon>Line

2. Click on chart, then “Alt” and “T” keys where you want to start line.

Once activated from either of the starting points (1), the function works on the current chart, without having to reactivate by clicking on the Header or Annotation icon.

Platform Features Release: November 2022

Announcing the latest Release allowing for customized Watchlist views. Improvements in Journal functionality will increase responsiveness and allow users to better control the data displayed. Format enhancements were also made to increase readability

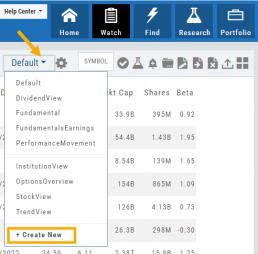

Watchlist Views – Create, Save & Edit

The ability to create your own Watchlist views based on criteria important to you enhances the work flow of finding the best candidates for trading.

Click on ![]() next to the (Default) Watchlist, then select “Add New” to get started.

next to the (Default) Watchlist, then select “Add New” to get started.

Build your own views from over 160 data points, then adjust the display position in the order you want them to appear.

Click on ![]() icon to edit a view you previously created.

icon to edit a view you previously created.

Learn more by clicking below:

Improvements

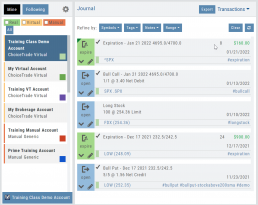

The Journal default displays Order/Trade activity from the Activated Trade Account.

To switch or add accounts, simply click on the other Account tabs or select by group: Real, Virtual, Manual or All accounts.

The improved functionality allows for faster journal activity display and easier trade analysis.

Change Log

- Resolved Score Icon Navigation from Home/Market Tab

- Corrected Fundamental/Dividend missing data

- Moving Average indicator functionality restored on Custom Page

- Corrected display data on Fundamental Tab

- Addressed candlestick not appearing first 20 minutes on Mondays.

- Rectified downloading data from Screener