Price Slices - Premium Feature

Price Slices

Price Slices allow users to view theoretical outcomes of option positions, while providing the flexibility of changing data points, such as entry price or what the results will be if the stock price moves a specific dollar or percentage amount.

This feature is helpful with building discipline on when to exit a trade if it goes against you.

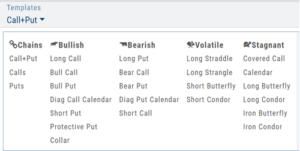

This feature is accessible when using the Strategy Templates on the Research>Option Tab

The default starting points include:

- Entry Point – shown in Blue in our example.

- High Point – considered Target or Resistance point – shown in Green.

- Low Point – considered Stop or Support point – shown in Red

(Up to 7 Price slices can be added for additional evaluation. See below for more details)

On Research>Option Tab, click the down arrow next to the default “Call+Put” view in the upper left corner of the window to access the Strategy Templates:

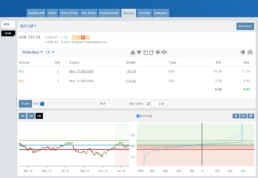

Select your Strategy and set up the position:

Quantity, Expiration Date, Strikes

On the right side of the same screen, click the ![]() button to display the default settings.

button to display the default settings.

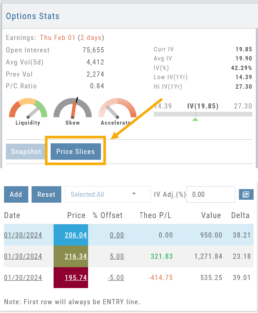

Using our example:

Entry point is $206.04 (Current Stock Price) shown in Blue

High point – defaults to 5% above Entry: $216.34, shown in Green/Gold

Low point – defaults to 5% below Entry: $195.74, shown in Red

The values are for ‘today’: what the Profit or Loss would be if the stock price were the High or Low price.

The Date, Price and/or % Offset can be manually adjusted, as indicated by the underline – to view different scenarios.

Price Slices – Adjust the % Offset Value

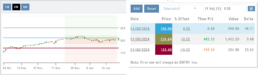

% Offset values were manually changed to 10% and -10%.

The lines on the graph are dynamically updated

Price Slices – Adjust the lines

In this example, the Top and Bottom lines were adjusted on the graph itself.

The new placement dynamically updated the values on the right.

Price Slices – Add, Reset, Go Big

Platform Features Release: Trade from the Chart, Price Slices, Reset Virtual Account Options

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the position evaluation process, trade submitting process as well as offer additional practice account settings:

Price Slices: Evaluate theoretical outcomes of option positions when using the Strategy Templates.

Trade from the Chart: Use the control box or lines on Chart to adjust the entry point, Target Price and/or Stop Price.

Reset Virtual Account – Add ‘funds’ to an existing account OR reset everything and start fresh. You decide.

Price Slices (Premium Feature)

The ![]() Button appears on the right side of the screen when using the Strategy Templates.

Button appears on the right side of the screen when using the Strategy Templates.

Select one of the 22 Option Strategy Templates.

Build the position.

Click the Price Slices button to start your evaluation

Change the Date (default ‘today’), Price levels and/or % Offset

Add IV to view how this affects the theoretical P/L

Click the Go Big icon to view additional Greek data

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

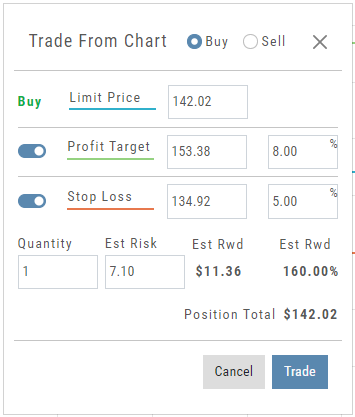

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

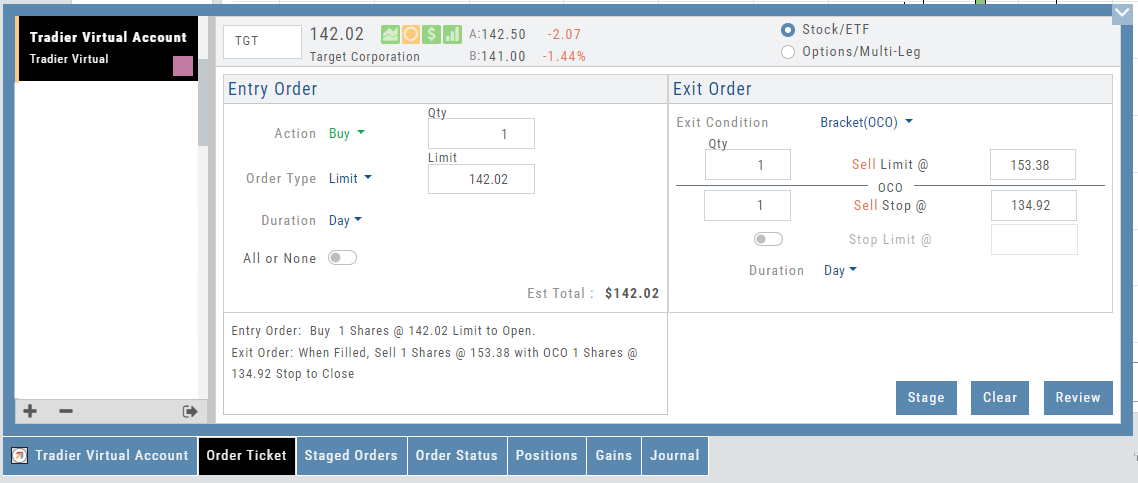

Click “Trade” for the prefilled Order Ticket to display.

The Order Ticket can be further adjusted, Staged or Reviewed to ensure it’s completed to your satisfaction, then Submitted.

Note: The brokerage selected must support Bracket Orders if the Stop/Stop Limit values are selected on the Order Window

Reset Tradier Virtual Account – 2 options

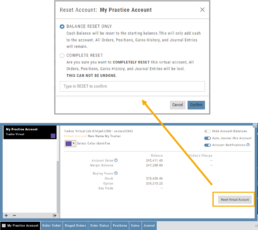

Tradier’s Virtual Account gives you the ability to add more “Cash” to your practice account – OR – completely start over:

On the account summary page, click “Reset Virtual Account”

Select “Balance Reset Only” – to keep your existing trade activity, but add more “cash” to your virtual account.

Select “Complete Reset” – if you want to remove all prior transactions, including Journal Entries, Gains, Orders, Positions, etc. Note: This selection cannot be undone once it’s processed.

Type RESET in the box provided, then click the “Confirm” button

Enhancements

- ATM Option Strikes are bolded for easier identification

Change Log

- Adjusted theme contrast

- Corrected Order Type Limit price entry

- Snapshot functionality restored

Position Notifications

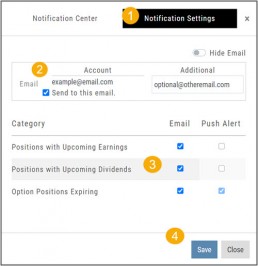

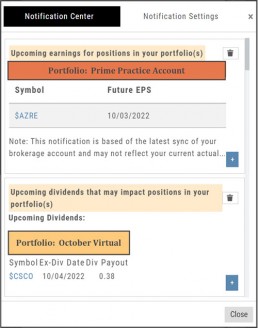

When you Enable and Activate Account Notifications, you’ll receive emails on upcoming activity that may affect your existing positions.

- Upcoming Earnings – Monday Morning via Email

- Upcoming Dividends – Monday Morning via Email

- Option Position Expiring – Two days prior via Email

To begin, locate and click on the Envelope Icon at the top of the platform page, next to your Username:

![]()

Follow the steps as outlined and illustrated:

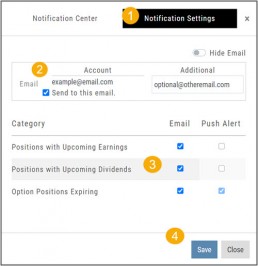

- Click on Notification Settings

- Add your email (Optional: Add 2nd email)

- Check/uncheck Categories

- Click “Save”

The settings can be updated at anytime by following the above steps.

Next:

For each account you want to receive notifications on, toggle the switch located on the Account Summary tab to the “On” position as shown in the graphic.

**Without this step, you won’t receive the notifications.**

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

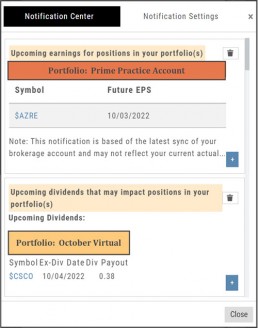

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Platform Features Release: October 2022

Announcing the latest Release of feature and functionality enhancements to the trading platform. These features and enhancements help keep users informed with activity on their trades. Functionality has been added to review a Watchlist in the Research tab, while being able to see at a glance which symbols have a price increase or decrease.

Notifications – Receive emails on upcoming Earnings, Dividends or Expiring Positions

Watchlist Research Functionality – Access and view your Watch Lists in the Research Tab via a drop-down box

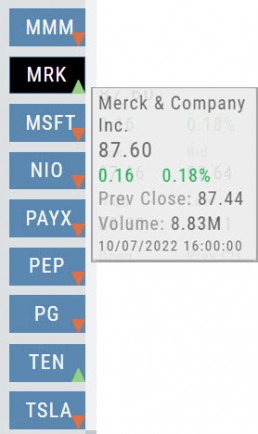

Price Action Arrows on Symbols in Research Tab – Instantly see latest price action while on the Research Tab

Trade Position Notifications – Premium Feature

Want to receive weekly emails of Expiring Positions, Upcoming Earnings and/or Dividends on existing trades you have in your accounts?

This Premium Feature allows you to do just that in a 2-part process:

First: Click on the the Envelope Icon at the top of the platform screen:

![]()

Go to “Notification Settings.”

Provide your email address(es).

Select Notifications you want to receive.

Click “Save”.

Next: On your Portfolio Accounts, go to the Account Summary Page and Toggle the switch to the On position.

Repeat this process for each Account you want emailed Notifications.

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Each Monday, prior to Market Open, an email will be sent where there’s Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

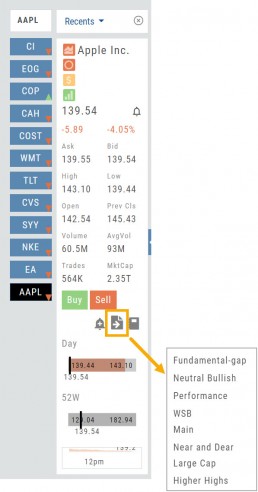

Research Watchlist Functionality

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

Change Log

- Upper Indicator responsiveness corrected

- Profitability info loads correctly on Fundamental Tab

- Completed Bear Put description on Strategy Template

- Corrected display data on Fundamental Tab

Platform Features Release: August 2022

Announcing the latest Release of feature and functionality enhancements to the trading platform. These allow for more customizing ability and streamlines functions on accessing or displaying information. Highlights include:

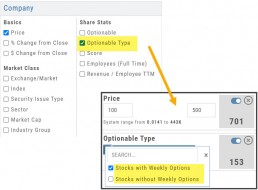

Screen for Weekly Options – The ability to screen for weekly options has been added to the Screen Function under Find.

Rearrange Screener Data Points – Change selection order directly on the Results page, by drag/drop action.

Large Chart Widget on Custom Page –The new widget fits an entire row on the custom page.

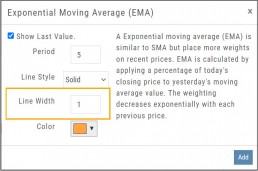

Customize Moving Averages – The Moving Average thickness can now be customized.

Vertical Zoom on Chart – Function expanding to allow for Horizontal and Vertical Zoom.

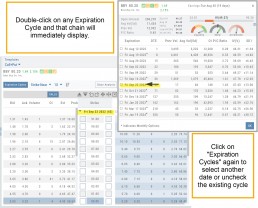

Double-click function on Expiration Cycle Page –Eliminates need to click “Okay” button

Screen for Weekly Options

The Screener – located under the Find Tab – now provides the ability to screen for Weekly Options.

Now customizing your own searches is even better!

Remember, you can save Screens for future use – and even edit/update them as needed.

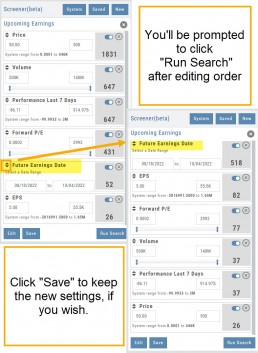

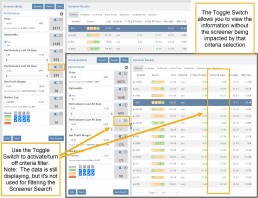

Rearrange Screener Criteria

Rearrange Screener data points on the Results page by clicking ![]() located on the upper left corner of each data point, then drag up/down.

located on the upper left corner of each data point, then drag up/down.

The data points are filtered with each entry in the order they are listed.

Additional edits can be made with the existing Screener data points:

Click ![]() to keep the data point but disregard in an updated “Run Search”.

to keep the data point but disregard in an updated “Run Search”.

Click ![]() to remove the data point from an updated “Run Search”.

to remove the data point from an updated “Run Search”.

Save to keep the edited Screener for future use.

Large Chart Widget on My Custom Page

An individual chart can be set on an entire row on the Custom Page by selecting the Large Chart widget.

The Custom Page set-up and arrangement remain the same.

Customize Moving Average Lines

All Moving Average Indicators, Exponential, Simple, Triangular and Weighted can be customized to set Line Width. The default setting is ‘1’.

This update, along with previously added, user-defined “Line Type” allows for even more identification in charting analysis.

Expiration Cycle Double-click Functionality

Quickly access one or more Expiration Cycles by double-clicking on each row you wish to evaluate.

The selected dates will automatically display on the Chain.

Click “Expiration Cycles” button again to revise/add to existing cycles.

Vertical & Horizontal Zoom Functionality

Change Log

- Corrected “Extend By” behavior on Chart with Streaming

- Created ability to reconcile partial trades

- Updated Annotation editing capability when adding text

- Resolved Edge browser/Annotations conflict

- Volatility Stop Indicator – expanded

- Fixed navigation break: Chain>Chart>Chain

- Analyze function restored on certain strategies

- Alert tool-tip correction

- Adjusting Parallel lines now saving

- Corrected Pending/Executed Order on Chart display

Platform Feature Release: Screener

Feature Release Notes: Screener

Announcing the latest feature/function updates, additions or edits to the trading platform:

Screener – Trading styles are unique. Screener, the platform’s newest feature allows for customized opportunity searches. Differing from Scans, which are predefined, Screener offers over 120 data points for customize searches based on what the user’s goals are. Additional data points will be forthcoming.

Screener searches may be saved and named for the user’s future use. In addition, System Screeners are available as starting point templates for the user to customize and save as personal Screeners.

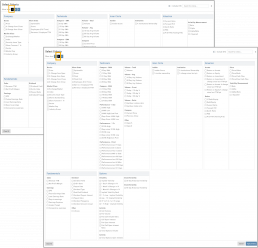

Screener

Located under the Find Tab, the Advanced Screener is designed to allow the user to customize their own trade candidate searches. Over 125 criteria selections are available – with more to follow.

Screener is flexible – allowing you to create save as many Screen searches as you wish, edit as needed, even download results.

Screens are user-defined, 100% customized by the user’s specifications. They can be edited, saved and deleted.

Left Control Panel

New – Create a new screener

Saved – Previously created and saved screens. Saved screens can be edited for a single-use or saved as a new screen or overwriting the previously saved screen

System – Templates available for use as starting points for new screeners. While the System screens themselves cannot be modified, they can be used as a foundation for newly created screens that – can be modified for personal use and saved.

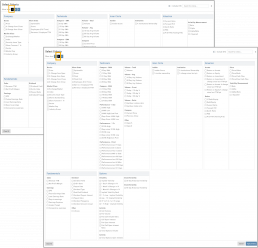

Select your Criteria

There are 3 Levels of Data. Currently Level 3 mirrors Level 2 – as more criteria will be added to this feature.

Level 1 offers Basic Information to select from. Level 2 expands upon what Level 1 offers.

After choosing your criteria, you’ll be able to set the parameters for each criteria selection on the next screen.

Click “Run Search”

Note: The order the criteria is selected, will be the order the selections are displayed on the next screen.

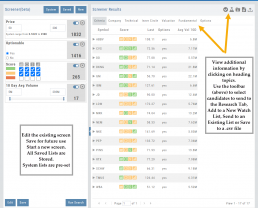

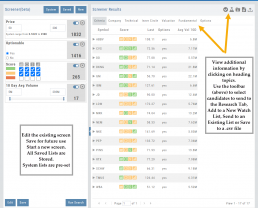

The Results

The criteria selected in this example were Price ($50-200), Optionable, Score (Green or Yellow for each Icon) and 10-day Average Volume (5M-293M) resulting in 17 candidates.

From here, using the Icon Toolbar, candidates can be selected and:

- Sent to Research for further analysis

- Sent to an existing Watch List

- Used to create a New list

- Can be download to a .csv file.

The Screen itself can be Saved (and named), further modified -either by

adjusting the existing criteria or adding new datapoints – or a New Screen

can be created.

Additional data is accessible by clicking on “Company”, “Technical”, etc

above the list of candidates.

System Screens are also available and new ones will be added.

The user can customize such screens and save to the platform just as any other

screen.

Candidates can be sent to Research, to a Watch List and/or

downloaded to a .csv file.

System Screens themselves cannot be modified and are designed to be

‘launching points’ for the user’s convenience if they wish to use them.

Note the colored bar graph of IV Range. It provides a ‘picture’ of where this

Stock/ETF is now for this datapoint.

Change Log

- TTM Squeeze Indicator added

- Option Chain column line up

- Double scroll bars appearing in Safari/Screener

- Split notification on Chart added

- Staged Order behavior -data loading resolved

- Trade Button appearance on Chart from Staged

- Industry Link responsive

- Mobile – corrected Stage Button function on Stock Order Ticket

- Mobile – updated “Save” Alert functionality

- Mobile – adding Indicator (Android) corrected

- Earnings < 7 days are noted in red

Screener (Premium Desktop Feature)

Screener

Located under the Find Tab, the Advanced Screener is designed to allow the user to customize their own trade candidate searches. Several hundred data points are available to select from, build your Screen, Save for future use and Edit as needed.

Screener is flexible – allowing you to create save as many Screen searches as you wish, edit as needed, even download results.

Screens are user-defined, and 100% customized to the user’s specifications. They can be edited, saved, and deleted.

Left Control Panel

New – Create a new screener

Saved – Previously created and saved screens. Saved screens can be edited for single use, saved as a new screen, or to overwrite the previously saved screen

System – Templates available for use as starting points for new screeners. While the System screens themselves cannot be modified, they can be used as a foundation for newly created screens that can be modified for personal use and saved.

Select your criteria

There are 3 Levels of Data.

Level 1 offers Basic Information to select from. Level 2 expands upon what Level 1 offers. Level 3 offers all available, in-depth selections.

After choosing your criteria, you’ll be able to set the parameters for each criteria selection on the next screen.

Click “Run Search”

Note: The order the criteria are selected, will be the order the selections are displayed on the next screen.

The Results

The criteria selected in this example were Price ($50-200), Optionable, Score (Green or Yellow for each Icon), and 10-day Average Volume (5M-293M) resulting in 17 candidates.

From here, using the Icon Toolbar, candidates can be selected and:

- Sent to Research for further analysis

- Sent to an existing Watch List

- Used to create a New list

- Can be downloaded to a .csv file.

The Screen itself can be Saved (and named), or further modified – either by

adjusting the existing criteria or adding new data points – or a New Screen

can be created.

Additional data is accessible by clicking on “Company”, “Technical”, etc

above the list of candidates.

Icon Tool Bar – Hover Cursor over Icon to view function

Select one or more symbols

Send selections to Research

Create a New Watchlist with Selected Candidates

Send Candidate to an Existing Watchlist

Download to .csv file

System Screens are also available and new ones will be added.

The user can customize such screens and save to the platform just as any other

screen.

Candidates can be sent to Research, to a Watch List and/or

downloaded to a .csv file.

System Screens themselves cannot be modified and are designed to be

‘launching points’ for the user’s convenience if they wish to use them.

Note the colored bar graph of IV Range. It provides a ‘picture’ of where this

Stock/ETF is now for this datapoint.

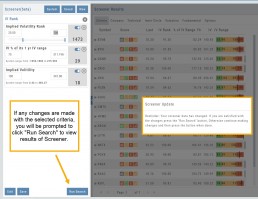

Edit Screeners

Edit current, Saved or System Screeners by adjusting parameters of existing criteria using the slide bars, entering values in boxes, etc.

A Screener Update notice will appear prompting you to select “Run Search” after adjustments are completed. Updated results will populate the left table.

From here, use the Icon Toolbar for further options: Select, Add to Watchlist, Research or Download.

Toggle Criteria

The Toggle feature gives you additional flexibility in your Screener searches.

The ON position includes the selected criteria in calculating results.

The OFF position for that criteria will not affect the results when used to filter results. However, that data column will still be displayed with the other points selected.

Platform Features Release: Additional Alert Functionality, Watch List Alerts, Info Button, Trade from Charts

Features Release Notes:

Additional Alert Capability, Set Watchlist Alerts, Alert Management Info Button, New Trade Button on Charts

Announcing: Expanded Alert Capabilities, Watchlist Alerts Information Button, Trade Function from Charts

We’ve increased Alert capabilities to give users more ability to identify trade entry, exit and management opportunities. An Info button (i) is added to on the Alert Management Page to assist/guide users on the criteria offered.

Set Alerts by Watchlist as well as individual symbol.

Trade functionality is available from the Charts, streamlining the process when you have an existing trade or staged trade. Where there are more than one position on the same symbol, you’ll be given the option of what action to take.

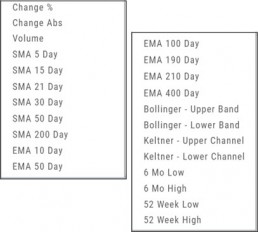

Increased Alert Functionality

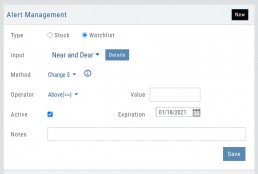

Set Alerts by Watchlist

You are able to set Alerts on your Personal Watchlists . There are 2 ways to do this:

1. On the Watch Tab using the Alert Icon in the Icon bar

2. The Alert Management Page, click “Watchlist”, then select from the drop-down which will automatically populate available lists to choose from.

Criteria available for single stock/etf symbols are available to set for an entire watchlist, include Real Time, up to 6 month activation and the ability to add Notes.

Clicking the “Detail” button will display the symbols contained in the selected Watchlist

With the exception of Last Price, all Methods are available for both individual alerts as well as Watchlist Alerts.

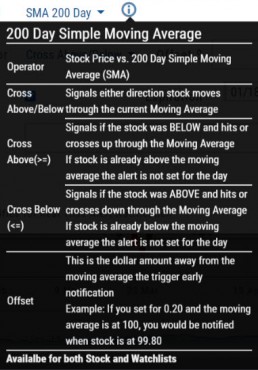

Simple Moving Average

Exponential Moving Average

Bollinger Bands

Keltner Channels

6 Month Hi/Low

52 Week Hi/Low

As you see, SMA & EMA offer numerous time periods. The shorter the time period, the more alerts you will receive – especially when set on Watchlists.

Note: The Active Alert box on the left side of the Alert Management page will have ‘wl‘ indicated when the alert is on a Watchlist.

A Reminder on Alerts:

Alerts are RealTime if you have Streaming Quotes on the platform – OR – have a linked brokerage account that provides RealTime quotes to the platform – AND – have logged into that account in the last 30 days.

Alerts on OTC stocks will be delayed

Make sure to enable “Push Notifications” on your computer as well as mobile devices (if you have the app downloaded). You do not have to be logged into the platform to receive alerts as long as you have these notices activated.

Information Button – Alert Management Page

An Information Button has been added to the Alert Management page.

Located next to the Method drop-down, (i) clicking on this button will display in-depth information on criteria available to set your alerts.

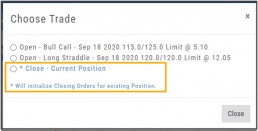

Trade from Charts (Live, Virtual, Manual or Staged Orders)

Submitting existing trades or staged orders is streamlined.

In the example chart above, there are two staged orders and a Live Trade.

Clicking “Trade“, located above the stock chart , will display a menu of an existing trade(s) in the activated trade account.

Staged Orders, on the same symbol, will display regardless of the trade account activated.

Staged orders will be shown in bold/black.

Active trades, whether Live, Virtual or Manual will be shown lighter/blue.

To the right is what displays after clicking “Trade”:

1. Open (Enter) the Bull Call Position

2. Open (Enter) the Straddle Position

3. Close the existing Active Trade (Manual, Virtual or Live)

The next action will take you to the Order Ticket to continue the trade process, as usual.

Change Log

- Ability to save Backtested trades after Market hours restored

- Dividend display corrected

- Adjusted links in BZ news

- Mobile App – scrolling issue resolved in Scans

Alert Functionality (Premium Desktop Feature)

Alert Functionality

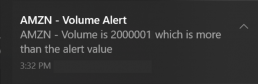

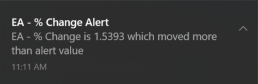

Alerts can greatly improve trading effectiveness by notifying you on a potential trade opportunity and help you decide when to manage, enter or exit a trade.

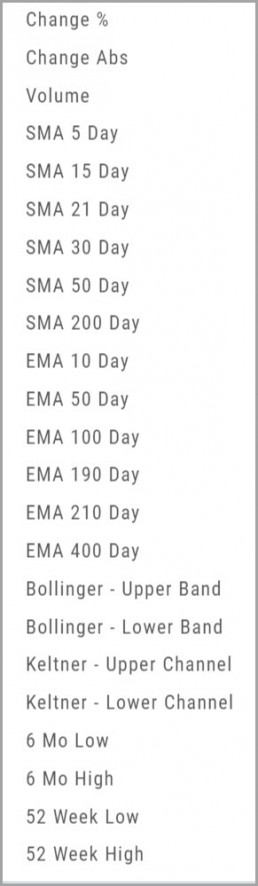

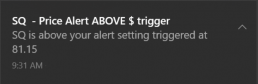

Set up Alert notifications based on Last Price, Volume, $ Change, % Change, or % Offset.

If you’ve logged into the platform with either Streaming Quotes or RealTime Quotes through a linked brokerage account *within the last 30 days* – Alerts will be Real Time.

Alert Icons

- Add (+) New Alert – This icon is located on the symbol Quote Box

- Hollow Bell – Active Alert, not triggered

- Shaking Bell – Triggered alert, not yet viewed

- Solid Bell – Alert triggered today, already viewed

- Paused (z) or Used Alert – located in Alert Management Page

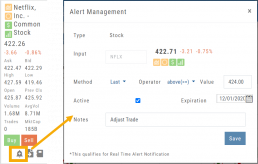

Set Your Alert

Click the Alert Icon, located on the symbol Quote Box. The symbol, Score Icons, Last Price, $ and % Change automatically fill in. To complete the rest:

-

-

- Select Method: 23 to choose from! See list below

- Select Operator: Above/Equal To or Below/Equal To

- Enter Value: $, % or Quantity (Quantity example: 11,000,000 or 11M)

- Select Expiration: Valid up to 6 months. Click on Calendar Icon to navigate months

- Add Notes, if desired

- Click Save

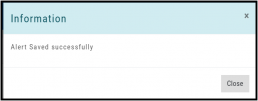

An Information notification appears: Alert Successfully Saved

-

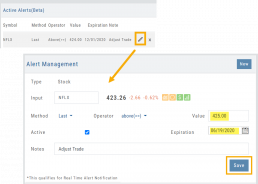

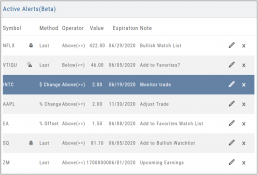

Alert Management

Manage your Alerts by going to: Research Tab>Alerts.

From this page, you can modify or remove alerts, view unread triggered alerts in one location and view prior alerts.

-

-

- Select Method: See List on right

- Select Operator: Above/Equal To or Below/Equal To

- Enter Value: $, % or Quantity (Quantity example: 11,000,000 or 11M)

- Select Expiration: Valid up to 6 months. Click on Calendar Icon to navigate months

- Add Notes, if desired

- Click Save

An Information notification appears: Alert Successfully Saved

-

Active Alerts

This table lists all active alerts including:

Trigger notification – A bell icon appears if alert was triggered

Delayed Alert icon, if applicable

Settings – Method, Operator, Value

Expiration Date – Alerts can be active for up to 6 months

Notes

Ability to modify or remove from list

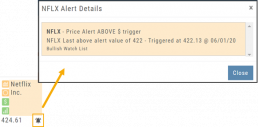

Alert Notifications

In addition to platform notifications, as long as you allow notifications, alerts can be sent to your computer or mobile device even if you are not logged into the platform.

Hollow Bell

The Hollow Bell indicates this Alert is Active, but has not been Triggeredwill appear next to the symbol whether on the QuoteBox in Research or on a Watchlist .

Ringing Bell

The Ringing Bell icon indicates the alert has been triggered and notification sent out. The highlighted area on the Quote Box or where it appears on a Watch List allows you to access the alert notification by clicking on the bell.

This display will show until the alert is read either from a Watch List, Quote Box or the Alert History section of the Alert Page.

Solid Bell

Once an Alert is read or “Marked As Read” on the Alert Notification page, the icon becomes a Solid Bell.

Clicking on the icon will still display the triggered alert until the next Market Day.

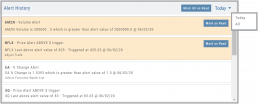

Alert History

This section displays triggered alerts for the time period selected: Today or All. The highlighted entries are Unread Notifications – the notices were not clicked on from the platform.

Click “Mark All as Read” to update entries.

A note about Real-Time & Delayed Alerts

Note: There are two ways 15 minute Delayed Alert Notification applies with Alerts:

1. If it’s been more than 30 days since a linked brokerage account with RealTime Quotes has been logged into – OR – the platform does not have Streaming Quotes.

2. OTC stocks will show as delayed, regardless of RealTime or Streaming Quotes

One of two notices will appear for each Alert

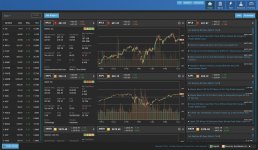

Custom (Premium Desktop Feature)

Custom Page – Customize What You Want To See

Custom Page

You’ll find Custom under the Home tab (formerly Market tab). Trade Central gives you a one-stop view of your selected Stocks/ETFs. Add Quote Boxes, Multiple Charts and News for your selections and overall Market News.

Rearrange the content to fit your preferences, the platform will adjust to maximize the view according to the device you are using.

This is a flexible feature with a number of ways to structure the Custom page. The widgets are adjustable, allowing you to rearrange, add, substitute or remove as needed.

Read below to learn more and get started:

Add Widgets

Check the box for “Quote“, “Chart“, and/or “News” and enter quantity for each then click “Enter”.

Add the Symbol in the appropriate box for the data to populate.

Note: To remove a widget, click the ‘x’ in the upper right corner of the box.

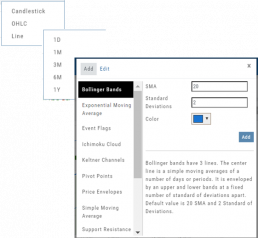

Chart Widget

After adding “Chart” widget and Stock/ETF symbol, click the Gear Icon (upper right corner of widget box) to select:

Time Period: 1 Day, 1 Month, 3 Month, 6 Month or 1 Year

Chart Types: Candlestick, OHLC or Line

Indicators: Over a dozen indicators available to add to each chart. You can edit and remove/change selected indicators on each chart.

Custom lets you add multiple chart set-ups per Symbol for a convenient way to research existing trades or find opportunities.

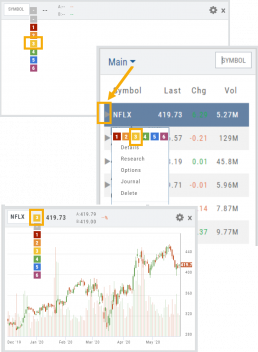

Widget Settings

Rather than enter a symbol on each Chart, Quote or News component, you can assign a number to each widget.

Then, using the Watchlist displayed on the left side of the screen, click the Action Icon (triangle) to left of Stock Symbol you want to display and assign a number, 1 thru 12

The widgets with that number will automatically populate accordingly.

To change displaying one symbol to another using a Watchlist, simply click on the Action Icon of new Symbol and select the number of the current Symbol you want to replace.

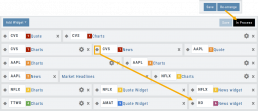

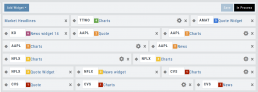

Adjust Custom Display

Adjust the order display by clicking on the Re-Arrange button on the Upper Right corner of Trade Central screen.

The display changes to placeholder bars for easy drag/drop action. Re-Arrange button changes to “In Process“.

Click on the Bulls-Eye icon to the left of the Stock/ETF symbol, then drag/drop to new location.

When completed, click on “Save“, then “In Process” to return to Trade Central main view.