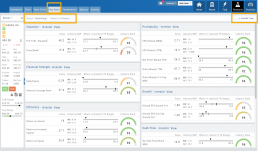

Key Ratio (formerly Valuation)

Key Ratio

A stock’s key ratios provide valuable insights into various financial aspects of the company. They are derived from the financial statements and help investors evaluate the company’s financial health, performance, and overall investment potential.

Assessing Key Ratios may vary by the type of trader one is: Growth Investors differ from Swing Traders who differ from Position Traders. The platform offers different views using Key Ratios for such scenarios.

Key Ratios allow you to not only view the company’s financial health but also view them in relation to others in the same industry, comparing ‘apples to apples’. Having this information allows you to better evaluate potential opportunities.

Deciphering the graphics

The illustrations show how to read the information provided as well as provide context on how the particular stock is performing to the Industry as well as the S&P.

Note: Depending on the Industry and/or S&P values, their tab(s) may not appear on the bar graph.

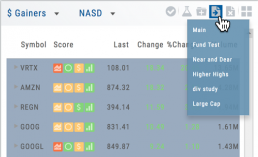

Select the view that matches your style of trading.

Just like trading, there is no ‘one-size-fits-all’. Those focusing on longer-term trades would not be interested in the same criteria as those who prefer shorter-term positions.

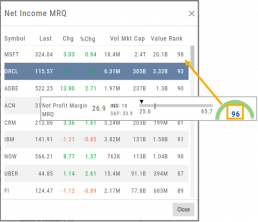

Clickable Key Ratio Value

View other industry stocks’ ranking by clicking on the numeric value as shown.

What does “N/A” or “–” indicate?

If a number does not appear in the Ratio criteria, you will see either a “N/A” or “—“

N/A indicates the datapoint is applicable, but the value not currently available

— indicates the data point does not apply, such as Inventory Ratios with Banks

The Power of "The Score"

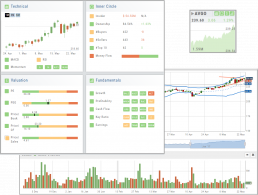

Our Proprietary Scoring System: Technical Analysis, Inner Circle, Valuation, and Fundamentals.

Designed with your workflow in mind and to give you the level of information you want, while keeping it out of the way when you don’t.

The order of The Score is based on the speed at which the stock is affected: Technicals being the fastest, and Fundamentals the slowest. For example, a very short term trader may not put as much weight on Fundamentals as with the Chart. However, as an actively managing investor, Fundamentals will be more influential on your trades.

Designed to provide the level of information you want

As much information you want. When you want it.

Each of our scoring algorithms are derived from several factors, all captured in a user-friendly format.

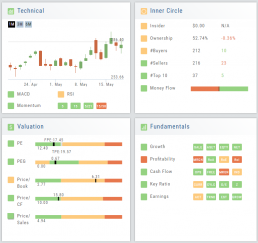

The stock dashboard provides a more detail summary layer view of The Score. Each component: Technical, Inner Circle, Valuation and Fundamentals allows you the ability to obtain the information you want, when you want it – and kept tucked away, when you don’t.

Technical Analysis

Technicals: The fastest indicators of The Score

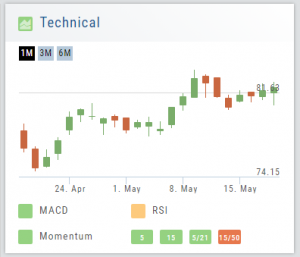

In Technical Score, 3 primary categories of studies are evaluated – MACD, RSI, and Momentum.

Momentum is made up of 4 different trend analysis timelines.

5 = Stock over the 5-day moving average

15 = Stock over the 15-day moving average

5/21 = 5-day moving average over the 21-day moving average

15/50 = 15-day moving average over the 50 day moving average

Note: Momentum indication is from fastest to slowest. This can be helpful in determining your time frame/outlook for the appropriate strategies.

By clicking on the Technical Score Icon anywhere in the platform, you’ll be taken to the Chart Tab under Research for that Company/Symbol.

Go to Charts for more in-depth information.

Inner Circle - Behind the Scenes

Insider and Institutional Activity.

Insiders’ and Institutions’ activities in a stock is a powerful tool.

Insiders: Our proprietary Insider Score looks at who the insiders are, how many there are, and how much stock is being bought or sold to derive a score algorithm.

Institutions: We monitor overall and individual institutions’ activities around a stock with historical comparison to evaluate the Institution Score.

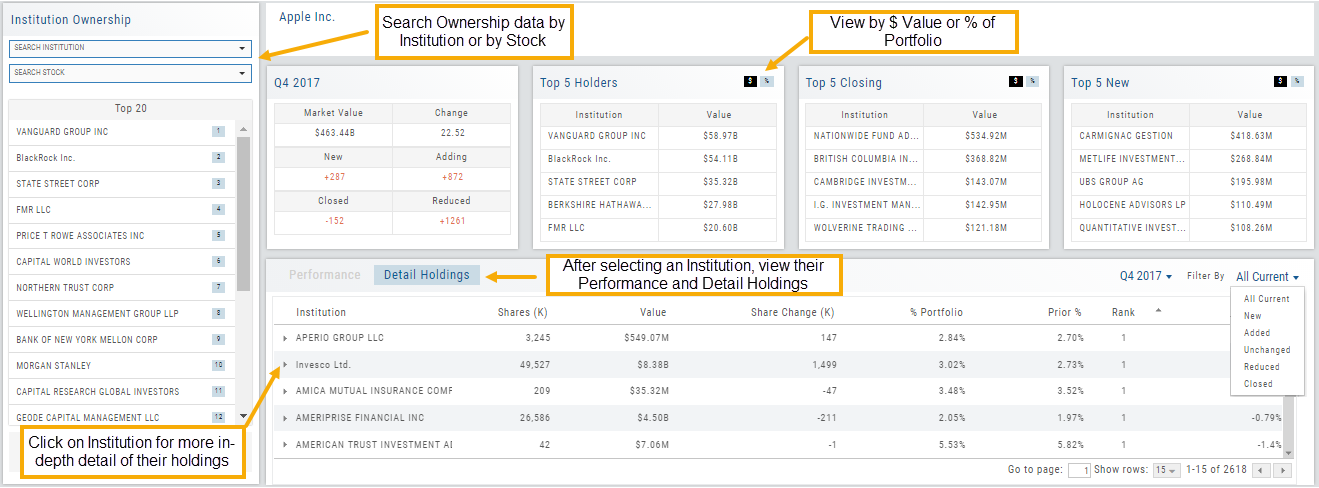

You have the ability to delve into as much information as you want by clicking on the ‘Detail’ box in “Insider Score” and “Institutions”. Find top buyers/sellers by week, month, 3 months, or one year. Search Institution Ownership by selected Quarter Report, newly added, reduced, current, top holders, etc. Dive deeper to gain insight into Institutions’ other holdings.

The information is easily accessible when you want it – just by the click of an icon, drop-down box, or arrow.

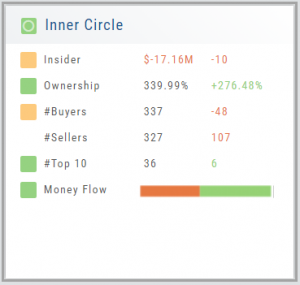

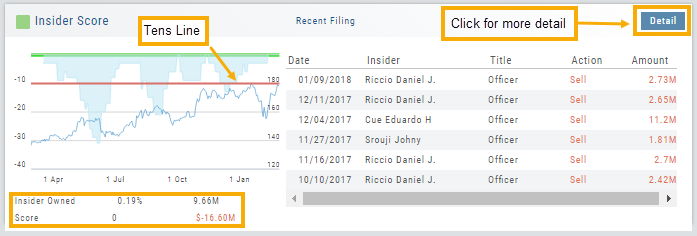

Inner Circle - Inside Score

The Insider Score window provides insight into the buying/selling activity of Company insiders. Clicking “Detail” provides more in-depth information on such activity.

The Tens Line provides a benchmark upon which to base the Inner Circle Score.

Zero & above – indicates net buyers and thus, a Green Score.

Between zero and -10 will yield a Yellow Score, as some insider selling is normal and expected.

A Red Score indicates heavier selling outside of a normal, expected range.

The bottom left of the window shows the % of all shares that are Insider Owned, equivalent $ amount last Quarter, the Score and Net Dollar amount traded last Quarter.

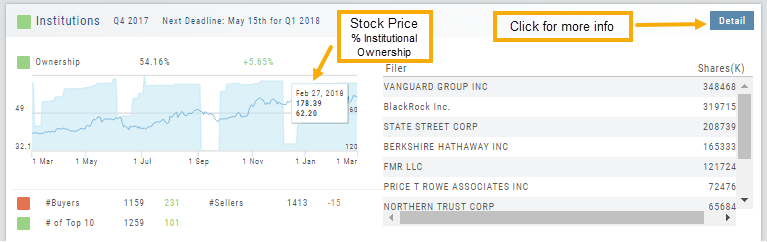

Inner Circle - Institutions

While Insiders are required to update their ownership status within a few days. Institutions are required to do so Quarterly.

The main tile shows data from the most recent reporting Quarter.

% Institutional Ownership and % change (+/-) from the previous Quarter

# of Buyers/Sellers with number gain/loss.

# of Institutions where the Stock is in their Top 10 Holdings

Note the Deadline for the Q1 2018 Report.

While the # of Buyers grew by 231 in Q4 2017, the number of Sellers outweighing buyers was enough to give this compenent a Red Score.

The # of Institutions holding AAPL grew enough to have a Green Score.

Clicking on “Detail” provides information on the last 20 Quarters. The information is layered allowing you to research ownership data further by Institution or Stock. You can further filter the ownership by those who added, reduced, dropped, unchanged etc. View holdings as a $ value or as a % of the Institutions’ portfolios.

Inner Circle - Money Flow

Activity by Volume & Number of Trades

Money Flow shows trading activity in two views.

The darker shade in the middle of each column – either dark green or red- indicates difference

between the buy/sell volume and buy/sell number of trades.

For example, on February 27th, the top graph shows approx. 1.75 Billion

buying volume from just over 50k trades (bottom graph). Selling volume of

approx 1.5 B resulted from less than 50k trades.

Where the volume and trade columns overlap is an indication of

‘big money’ (Institutions) moving in(dark green)or out (dark red)

of the stock.

Note the dark green line overlap on both graphs for the Feb. 27th example.

Valuation

Is it Overvalued or Undervalued?

Valuation looks at Key Ratios and Projected Price to evaluate the stock’s current value.

Key Ratios like both trailing and forward PE along with PEG (Price/Earnings/Growth) are weighed.

The Price compared to Book (flow of business), Cash Flow, and Sales are also very important factors to provide a well-rounded synopsis of the valuation modeling of the stock.