Entering a Position

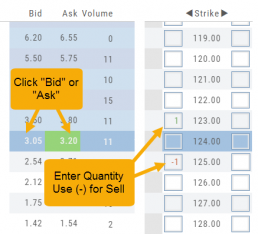

You can enter a position to analyze by clicking on ‘Ask’ for buying or ‘Bid’ for selling. You can also directly enter the quantity in the entry box. (Note: make sure to indicate a selling position with a minus (-) sign).

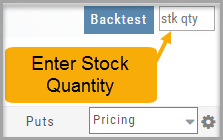

For positions that include the underlying stock, such as Covered Calls, Protective Puts & Collars, enter the stock quantity in the upper right corner of the chain window.

You can change the click quantity amount by changing the default-click parameter (found at the top of the Option Table) for 1x, 5x or 10x.

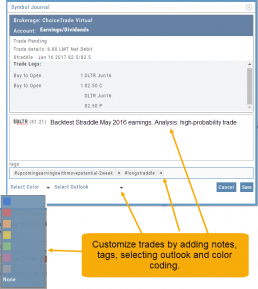

Symbol Journal

This is more than just documenting trades

This Journal has benefits and features that allow you to truly customize a vital part of the trading process. Each trade allows you to: Make Notes, add Tags for organizational purposes as well as Color Tags you customize, Outlook icons further customize each trade entry.

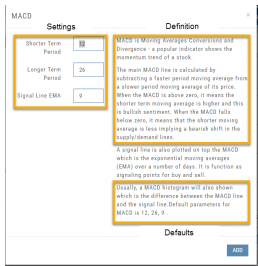

Customizing Indicators

Customize Indicator Settings – even in different Chart Profiles!

Customize the settings by clicking on the “Add Indicator” box at the top, center of the screen. Scroll to the Indicator you wish to add/edit. Left-click on the selection for a customization box to appear.

The Indicator window shows which settings can be changed.

Bonus! You can save different settings for the same indicator in different chart profiles. No need to change settings from one profile to the next.

In addition to the settings, this feature also provides a description of the indicator and the default settings.

Where are the Greeks?

You may come across instances on the Options Chain where Delta, Gamma, Theta & Vega fields are blank.

This occurs when the Extrinsic Value of the Option Strike Price is Negative. Negative numbers cannot be used to calculate the sensitivity of an option’s price underlying stock price changes, changes in volatility and passage of time.

Some platforms may place a ‘0’ (zero) vs. keeping the field blank. This is not entirely accurate, as ‘0’ is a valid number

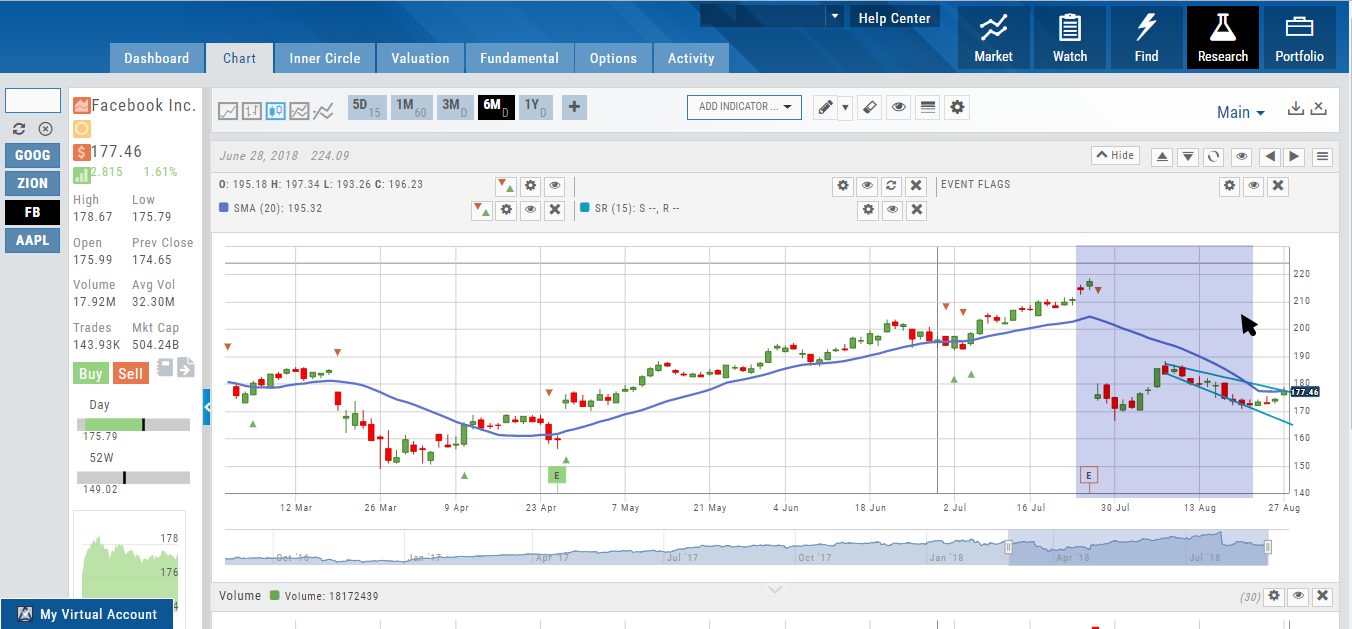

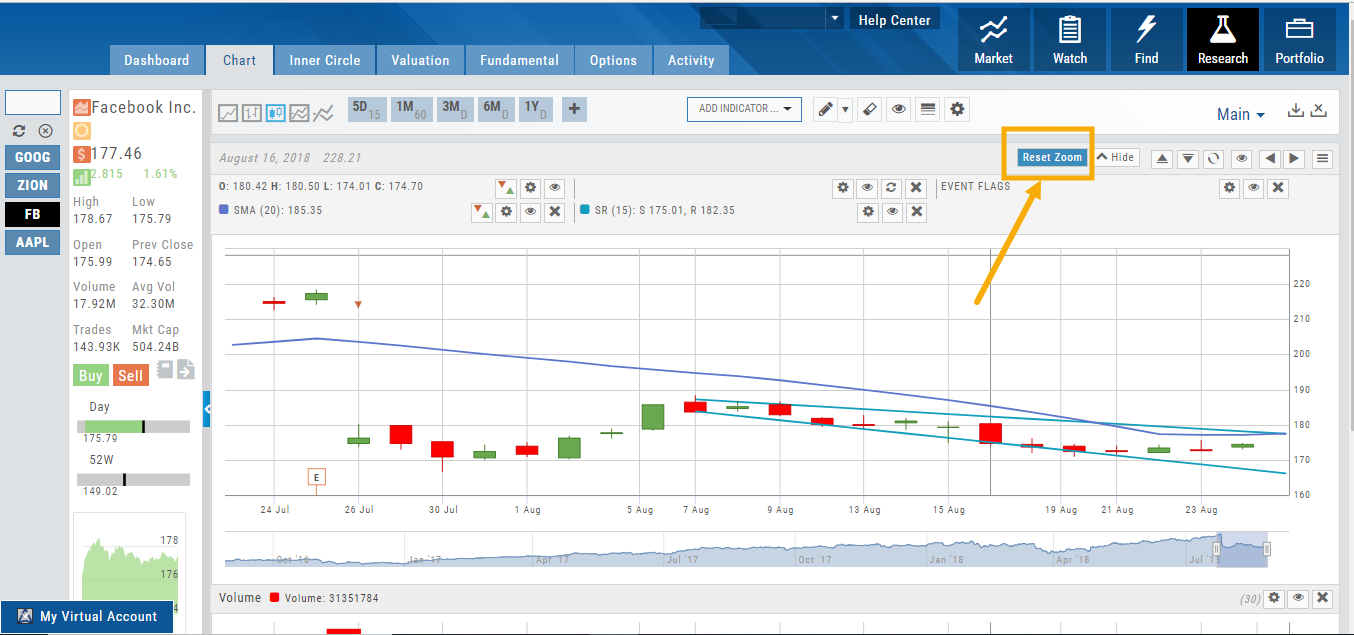

Zoom Feature

Zoom in on any chart display, then easily reset to the default setting.

Simply click your cursor on the chart and drag to highlight the area to ‘Zoom’:

A “Reset Zoom” button will automatically appear on the new display. When you are finished with your studies, simply click to restore the original time-period setting.

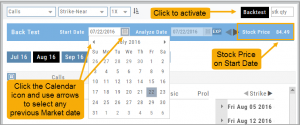

Start Date

Click the Calendar and select any past Market date. You can quickly choose a previous date by clicking on the “month” then arrow back by year. The closing price for that stock will be displayed.

You are now ready to create the position to analyze – either by clicking “Bid” or “Ask” or by entering the quantity in the appropriate box(es).

Note: In order to ‘backtest’, the platform needs to establish an orientation point in time. If you change the ‘start date’, the option expiration cycle may change to re-establish the reference point in which to pull information from.

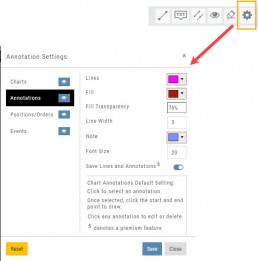

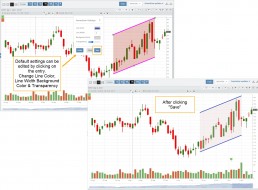

Trend Lines, Notes & Shapes and Advanced Annotations

Customize your charts with Trend Lines, Notes and Advanced Annotations.

These tool icons are available above the chart, just below the Indicators drop-down box.

These tool icons are available above the chart, just below the Indicators drop-down box.

The Gear Icon sets/manages the default for these tools, as well as whether to save Trendlines, Notes & Annotations on the chart (recommended).

Each Trendline, Note Entry and Annotation can be individually customized by color and, where applicable, transparency.

Clicking on any Trend Line, Note, or Advanced Annotation, will display the “Annotation Settings” box for that entry.

The Annotation Settings box can be repositioned elsewhere on the platform, if needed.

Line Color, Line Width and if applicable, Background Color and Transparency can be changed.

Be sure to click ‘Save’!

Note: Parallel channels are initially drawn horizontally. To change orientation click on the annotation then grab one of the ‘edit dots’ to drag to the position you wish.

Then click “Save” on the dialog box.

Crossover Arrows

The Crossover Arrows ![]() identify the crossover points on indicators.

identify the crossover points on indicators.

For upper indicators, you can select 2 indicators and the chart will show the crossover arrow.

Example: If you select the 5 day and 20 day SMA the Green arrows will show the 5/20 crossover points when in an upward movement, Red for downward.

Only 2 moving averages can be selected at a time when utilizing this tool. If you wish to make a change to another moving average indicator, one must first be deselected before adding the new indicator.

indication

Journal Tag Analytics

Want to know how effective your trading strategies and practices are? This is where you’ll get your answers

Get visual feedback broken down by strategies and analytical data including a Profit Graph, Average Gross P&L, the frequency of each strategy executed, % Win Ratio, Number of Days in a Trade.

Journal Analytics is a powerful tool to reinforce consistency in the practice of the trading process- from the overview, evaluation, research, execution and exiting. Journaling identifies what works, what needs more discipline, etc. Analytics provide this information in easy-to-read data.

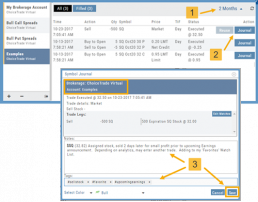

Updating Journal Entries

Updating closed or adjusted trades in the Journal Tab is easy by the following steps:

1. Go to the Order Status Tab, change the default “Today” in the upper-right area of the tab for previously executed trades.

2. Click “Journal” for the trade you want to update.

3. You can add Notes, #tags, outlook to be included in the Journal. Click “Save”. (Note the Account Name where this trade will appear)

4. The trade is now updated in the Journal Tab. Expand the tab to see trade detail: Number of days in the trade, the profit (loss), order execution details, notes, tags, the Account Name containing the trade, etc.

The Analytics section will update using tags from these trades, further assisting in tracking progress in your trading.