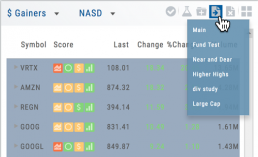

Save your Favorite Scans

Create your Customized Scan List

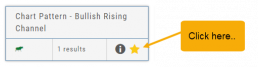

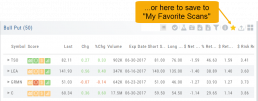

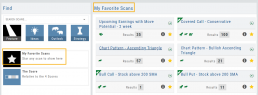

Star any scan to have it show in Feature > My Favorite Scans.

There are two ways to do this:

Simply click the star ![]() on the Tile View of the scans or on the header in the results view of any scan.

on the Tile View of the scans or on the header in the results view of any scan.

Favorites will be easily access from the Scan main page

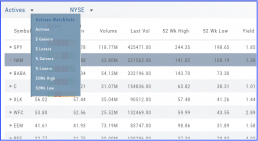

The Other Lists

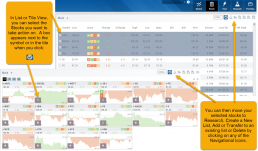

In addition to your Personal and Dynamic Watch lists, the platform also provides “Actives Watch lists” from which you can add results to a new or existing Watch list.

If you want to eliminate low price, low volume stocks, click on the appropriate header to sort, then you can either click/drag to highlight the ones you want to delete – or – click the Check icon from the navigational icons to select the ones to delete – or to send to Research or another Watch List. ![]()

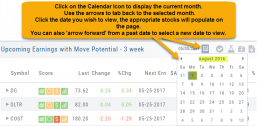

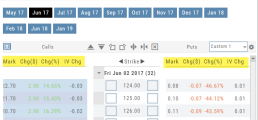

Past Scan Results

When viewing scan results, you can select a past date by clicking on the Calendar Icon, then the back arrow until you get to the month you want to search from. Click on the date you wish to view & the appropriate stocks will populate the screen.

The date you are searching will be displayed in the header

Note: Past Scans availability dates vary. When a new scan is added, the history is available from the day it was added to the platform going forward.

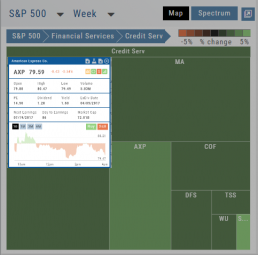

Heat Map & Spectrum Overview

Broad Market Insight that allows you to drill down

The Heat Maps are accessible in the Market tab and under Find>Explore and provide powerful visual views of market performance. This feature is designed to adapt to a variety of strategies and outlooks according to your portfolio needs. Select Index and Time Frame using the Action Icons. These can be changed going forward in any map screen.

In the Map view, each box represents either an industry group (default) or a stock when you drill down. The size of the box represents the market cap. By hovering your cursor over each box, an info box appears with info on that group within that industry, including the the number of companies, Market Cap, % Change in selected time frame.

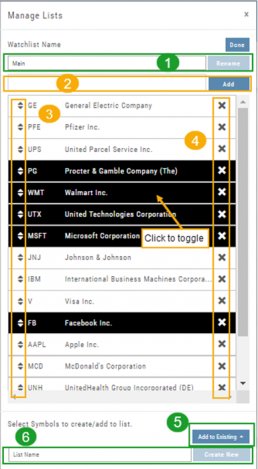

Manage/Modify Watchlists

The Modify feature offers the following Symbol and List Management capabilities in one location:

- Rename the current Watchlist

- Add Symbols to the current Watchlist

- Use up/down arrows to drag/rearrange symbols in selected List

- Remove symbol(s) by clicking on ‘X’

- Highlight symbol(s) to add to another Existing Watchlist

- Highlight symbol(s) to Create a New Watchlist

Bonus! You can keep your Watchlist sorted by any heading using this feature:

Select your Watchlist

Sort by any Heading (Example: Price – High to Low)

Click on the Manage Icon, then click “Done” at the top of the screen

This setting will be ‘sticky’ until you change it.

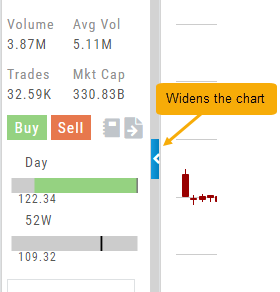

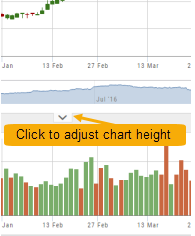

Adjust Chart Height & Width

The height of the chart can be adjusted by clicking and dragging the tab under the main chart.

This is a feature unique per device. You can have separate settings for your laptop/desktop,notebook or even tablet.

To widen the chart, click the blue tab on the left side of the chart. This will collapse the Quote Bar to the left of the chart. You can ‘undo’ this by clicking the tab again.

Heat Maps Too

The Heat Maps on the Market page offer the ability to drill down to the stock level. You are able to do this with both the Map and Spectrum views. Clicking on a stock will also show the quote detail. From this you can also send to a list or research.

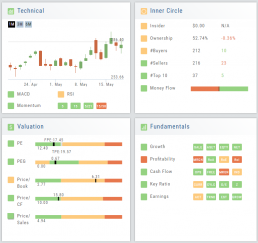

Valuation

Is it Overvalued or Undervalued?

Valuation looks at Key Ratios and Projected Price to evaluate the stock’s current value.

Key Ratios like both trailing and forward PE along with PEG (Price/Earnings/Growth) are weighed.

The Price compared to Book (flow of business), Cash Flow, and Sales are also very important factors to provide a well-rounded synopsis of the valuation modeling of the stock.