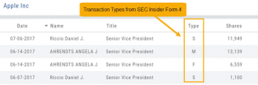

Trade Transaction Types

Rule 16b-3 Transaction Codes

A — Grant, award or other acquisition pursuant to Rule 16b-3(d)

D — Disposition to the issuer of issuer equity securities pursuant to Rule 16b-3(e)

F — Payment of exercise price or tax liability by delivering or withholding securities incident to the receipt, exercise or vesting of a security issued in accordance with Rule 16b-3

I — Discretionary transaction in accordance with Rule 16b-3(f) resulting in acquisition or disposition of issuer securities

M — Exercise or conversion of derivative security exempted pursuant to Rule 16b-3

Derivative Securities Codes (Except for those exempt pursuant to Rule 16b-3)

C — Conversion of derivative security

E — Expiration of short derivative position

H — Expiration (or cancellation) of long derivative position with value received

O — Exercise of out-of-the-money derivative security

X — Exercise of in-the-money or at-the-money derivative security

Other Section 16(b) Exempt Transaction and Small Acquisition Codes (except for Rule 16b-3 codes above)

G — Bona fide gift

L — Small acquisition under Rule 16a-6

W — Acquisition or disposition by will or the laws of descent and distribution

Z — Deposit into or withdrawal from voting trust

Other Transaction Codes

J — Other acquisition or disposition (describe transaction)

K — Transaction in equity swap or instrument with similar characteristics

U — Disposition pursuant to a tender of shares in a change of control transaction

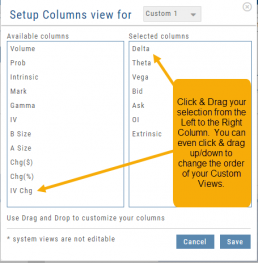

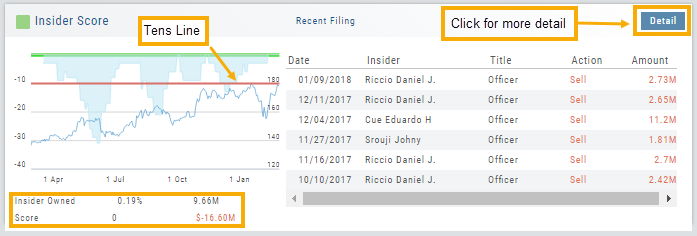

Inner Circle - Inside Score

The Insider Score window provides insight into the buying/selling activity of Company insiders. Clicking “Detail” provides more in-depth information on such activity.

The Tens Line provides a benchmark upon which to base the Inner Circle Score.

Zero & above – indicates net buyers and thus, a Green Score.

Between zero and -10 will yield a Yellow Score, as some insider selling is normal and expected.

A Red Score indicates heavier selling outside of a normal, expected range.

The bottom left of the window shows the % of all shares that are Insider Owned, equivalent $ amount last Quarter, the Score and Net Dollar amount traded last Quarter.

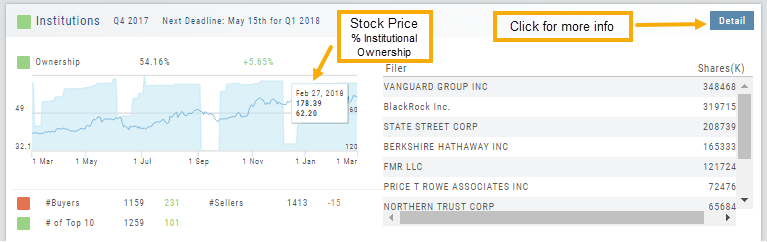

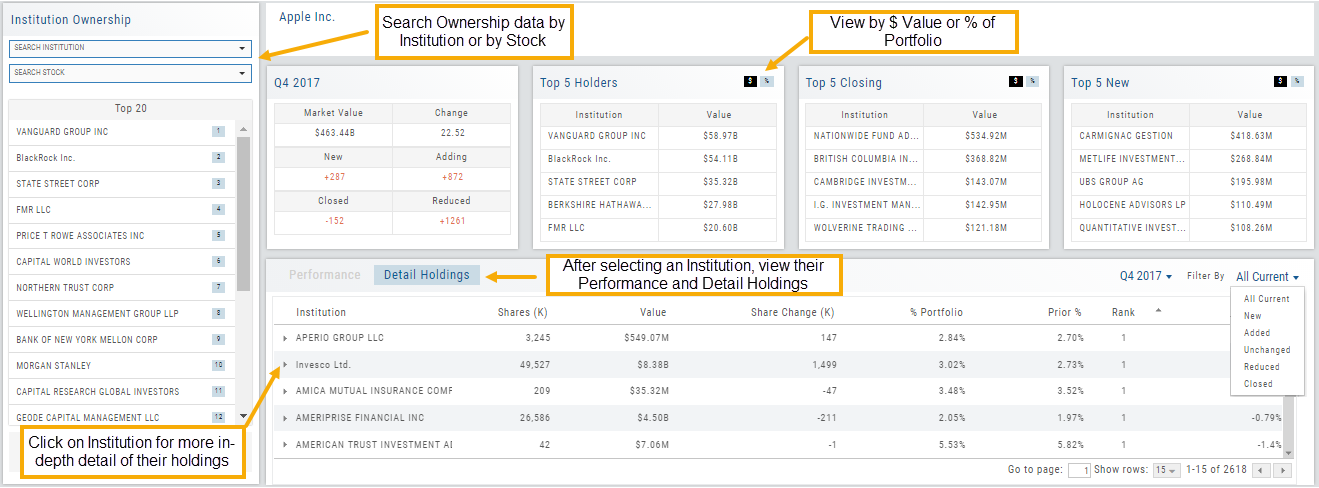

Inner Circle - Institutions

While Insiders are required to update their ownership status within a few days. Institutions are required to do so Quarterly.

The main tile shows data from the most recent reporting Quarter.

% Institutional Ownership and % change (+/-) from the previous Quarter

# of Buyers/Sellers with number gain/loss.

# of Institutions where the Stock is in their Top 10 Holdings

Note the Deadline for the Q1 2018 Report.

While the # of Buyers grew by 231 in Q4 2017, the number of Sellers outweighing buyers was enough to give this compenent a Red Score.

The # of Institutions holding AAPL grew enough to have a Green Score.

Clicking on “Detail” provides information on the last 20 Quarters. The information is layered allowing you to research ownership data further by Institution or Stock. You can further filter the ownership by those who added, reduced, dropped, unchanged etc. View holdings as a $ value or as a % of the Institutions’ portfolios.

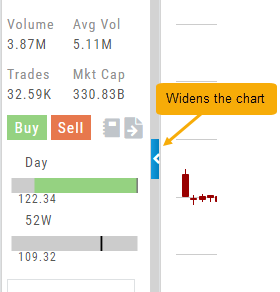

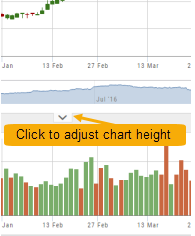

Adjust Chart Height & Width

The height of the chart can be adjusted by clicking and dragging the tab under the main chart.

This is a feature unique per device. You can have separate settings for your laptop/desktop,notebook or even tablet.

To widen the chart, click the blue tab on the left side of the chart. This will collapse the Quote Bar to the left of the chart. You can ‘undo’ this by clicking the tab again.

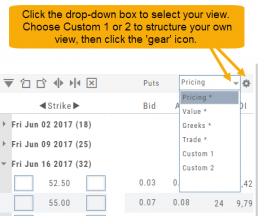

Create Customized Option Table Views

Create, edit and re-create custom Option Views.

This feature allows you to create up to two customized Option Tables. Add/remove categories or even change the order of category columns by clicking on the criteria, then drag/drop it to the new location.

Click ‘save’ and you’re done.

Note: You can change the order of your variables you select by clicking/dragging the variable up or down. The custom views can be changed at any time – to adjust to the user’s needs.

Inner Circle - Money Flow

Activity by Volume & Number of Trades

Money Flow shows trading activity in two views.

The darker shade in the middle of each column – either dark green or red- indicates difference

between the buy/sell volume and buy/sell number of trades.

For example, on February 27th, the top graph shows approx. 1.75 Billion

buying volume from just over 50k trades (bottom graph). Selling volume of

approx 1.5 B resulted from less than 50k trades.

Where the volume and trade columns overlap is an indication of

‘big money’ (Institutions) moving in(dark green)or out (dark red)

of the stock.

Note the dark green line overlap on both graphs for the Feb. 27th example.

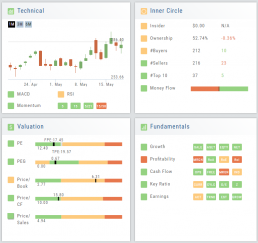

Valuation

Is it Overvalued or Undervalued?

Valuation looks at Key Ratios and Projected Price to evaluate the stock’s current value.

Key Ratios like both trailing and forward PE along with PEG (Price/Earnings/Growth) are weighed.

The Price compared to Book (flow of business), Cash Flow, and Sales are also very important factors to provide a well-rounded synopsis of the valuation modeling of the stock.

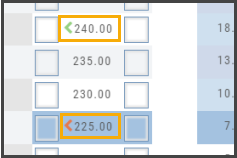

Position Indication on the Chain

When evaluating an existing position on the options chain, the positions held are indicated with arrows on the chain. The arrows point to the quantity entry box of the held position.

Green arrows ![]() indicate Long or Buy positions.

indicate Long or Buy positions.

Red arrows ![]() indicate Short or Sell positions.

indicate Short or Sell positions.

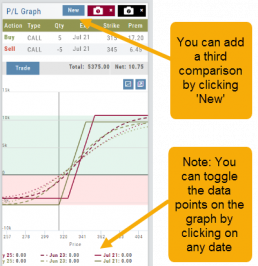

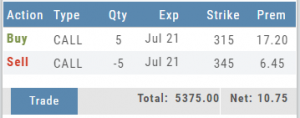

Snapshot: Comparing Positions

The Snapshot feature gives you the ability to compare up to three scenarios in one view without having to change screens or erase previous setups. You can even submit a trade from this part of the platform!

- From the Calls+Puts chain (as well as “Calls” or “Puts”) enter the initial trade position.

- Next click one of the camera icons:

- Repeat the first step using the Rolling Icons to adjust the initial position to a new scenario:

- Click the 2nd camera icon & repeat the above steps for the last trade comparison.

Note: The position lines are color coded to match the Snapshot (or New) icon.

Once you decide on the optimal position, click ‘Trade’ from the P&L Graph and you’ll be taken to the Order Ticket of your brokerage account with the option information auto-filled.

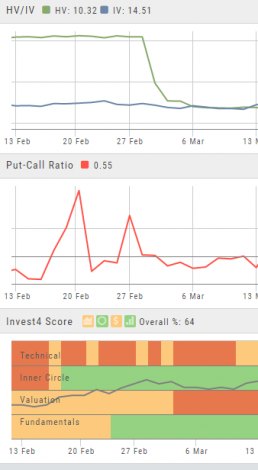

Advanced Indicators

We offer select Advanced Upper and Lower Indicators that are not just derived from the price, including proprietary indicators like “Invest4Score” and “Insider Score”. They are accessible by using the “Add Indicator” drop-down box.

Upper Indicators include:

- Event Flags – showing Earnings and Dividends

- Journal Display

- Support/Resistance

- Extrema Trend Lines

Lower Indicators include:

- Historic Volatility/Implied Volatility

- Insider Score

- Institutional Percentage

- Invest4 Score

- Momentum Score

- Open Interest

- Options Volume

- Put Call Ratios