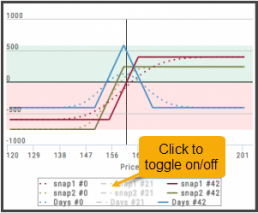

Clickable Legends

When comparing trades using the Snapshot feature, the P/L Graph can get a little crowded. You can clear some of the lines by simply clicking on the legend to toggle visibility.

Clickable legends are also available in other graphs and charts within the platform.

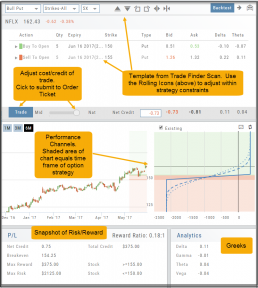

Elements of the Template

The Trade Finder Templates are designed to allow you to ‘visually trade’.

When evaluating a position, a Bull Put for example, the template automatically sets up the trade. You can use the rolling icons to adjust the position: Roll the position up/down, roll out the time frame, adjust the strikes, etc. You can even adjust the Net Credit(Debit) of the trade in an attempt to get a more favorable entry cost/credit.

The Performance Channels show the profit/loss of the position.

The P/L summary at the bottom left of the screen shows the Risk/Reward ratio, Net/Total Credit (Debit),the break-even stock price point, the max reward/max risk with corresponding stock price.

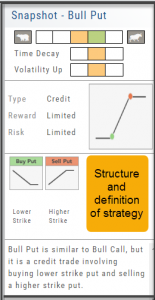

A snapshot on the right side of the screen, provides a visual structure of the strategy, what market  conditions are favorable to the trade, whether volatility and/or time positively, negatively or is neutralized by the strategy.

conditions are favorable to the trade, whether volatility and/or time positively, negatively or is neutralized by the strategy.

Greeks and Volatility are also shown.

Once satisfied with the position set-up, click ‘Trade’ and the order will auto-fill in the “Order Ticket” of your brokerage account.

Important! While adjustments may to the template may be made, the system limits what can be changed in order to stay within the constraints of the strategy. This safety measure ensures you stay in the type of trade you intend to be in.

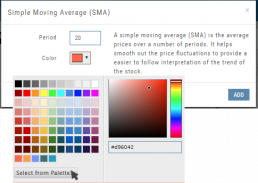

Adding & Arranging Indicators

Select ![]() to add to your studies.

to add to your studies.

Indicators are grouped by Upper Indicators (which will appear on the Chart) and Lower Indicators (listed below the chart)

Once selected, you can customize the parameters – including the type of line you want for Moving Averages.

The upper Indicator selection summary appears above the chart and has an associated toolbar that allows edits (gear) hide/display(eye), refresh, or remove.. ![]()

Lower indicators can be displayed/hidden, move placement up/down, or delete it to truly customize your view. ![]()

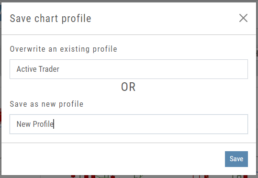

Make sure to Save Your New Chart Settings ![]()

Note: You cannot alter System Views: Active Trader, Options or Standard View. You will be prompted to either Overwrite or Save as a New Profile another available profile, such as Default or another Personal View.

Historic & Implied Volatility

This chart displays Historic (HV) and Implied (IV) Volatility with the ability to overlay Call/Put IV

Historic Volatility (green line) is based on how the stock actually moved.

Implied Volatility (blue line) is based on how the options are priced.

When expanded, the stock chart, 12-Month Mean (Average) IV and one-year IV High/Low (red line) are also shown. This is very helpful in understanding if option premiums are comparable to historic values.

High HV indicates recent strong movement.

High IV indicates higher premium and, in many cases, anticipated movement.

Note: You can remove the Stock Chart, HV, IV or Call/Put IV simply by clicking on the corresponding indicator above the chart/graph.

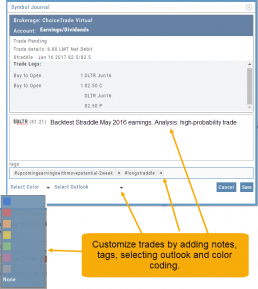

Symbol Journal

This is more than just documenting trades

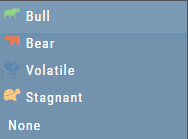

This Journal has benefits and features that allow you to truly customize a vital part of the trading process. Each trade allows you to: Make Notes, add Tags for organizational purposes as well as Color Tags you customize, Outlook icons further customize each trade entry.

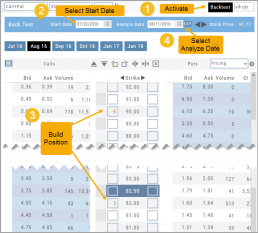

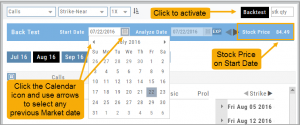

Start Date

Click the Calendar and select any past Market date. You can quickly choose a previous date by clicking on the “month” then arrow back by year. The closing price for that stock will be displayed.

You are now ready to create the position to analyze – either by clicking “Bid” or “Ask” or by entering the quantity in the appropriate box(es).

Note: In order to ‘backtest’, the platform needs to establish an orientation point in time. If you change the ‘start date’, the option expiration cycle may change to re-establish the reference point in which to pull information from.

Journal Tag Analytics

Want to know how effective your trading strategies and practices are? This is where you’ll get your answers

Get visual feedback broken down by strategies and analytical data including a Profit Graph, Average Gross P&L, the frequency of each strategy executed, % Win Ratio, Number of Days in a Trade.

Journal Analytics is a powerful tool to reinforce consistency in the practice of the trading process- from the overview, evaluation, research, execution and exiting. Journaling identifies what works, what needs more discipline, etc. Analytics provide this information in easy-to-read data.

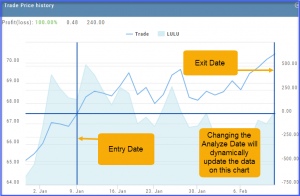

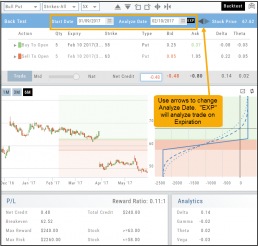

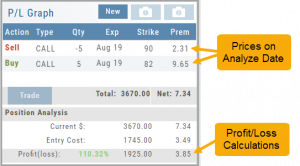

Analyze Date

After the position is entered, click on the “Analyze Date” calendar to select the date.

![]()

You can click “EXP” to further analyze the trade on the option’s expiration date or use the arrows to move the original analyze date forward or back.

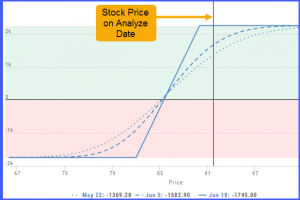

Your Position Analysis will display with estimated gain/loss calculations and the P/L Graph.

The P/L Graph will also display the stock price on the analyze date via the vertical line.

Note: The prices in the options chain will show the start date prices. The prices in the Analysis Panel will reflect the Analyze Date prices.

Note: The prices in the options chain will show the start date prices. The prices in the Analysis Panel will reflect the Analyze Date prices.

Once you have selected your date for analysis, you can edit the position, or try a different position, and the analysis will dynamically update.

Backtesting Trade Finder scans

You can ‘look back’ (Backtest) Trade Finder Scans by following these steps:

- Select your Scan (example: Bull Put – Stock above 200 SMA).

- Click on the Calendar at the top of the screen to select a previous date (clicking on the month allows you to select a previous month, or arrow back to a previous year).

- Select stock symbol, click on action icon to ‘Analyze Position’.

- The trade template will populate with the specific scan, note the date on the screen is the ‘start date’

- Select the Analyze Date, or click ‘EXP’ to analyze the position on Expiration Day.